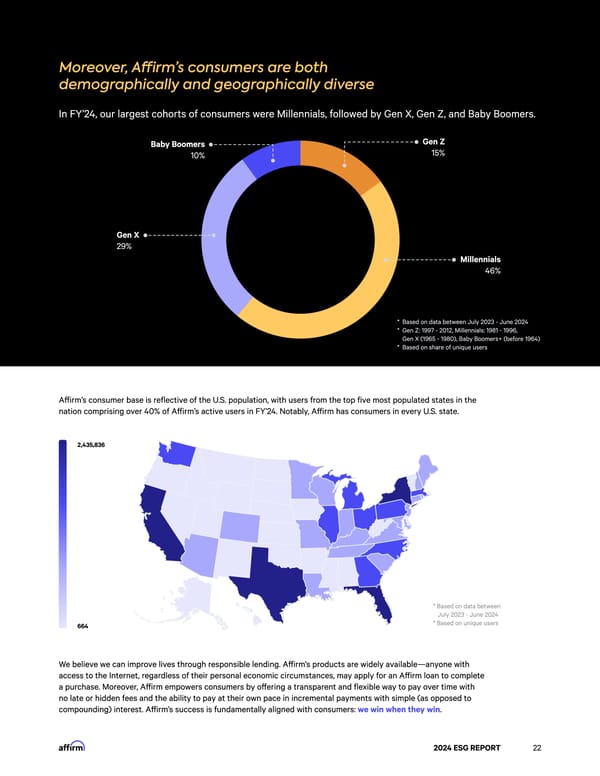

Moreover, A昀케rm’s consumers are both†⠀ demographically and geographically divers漀 In FY’24, our largest cohorts of consumers were Millennials, followed by Gen X, Gen Z, and Baby Boomers. Gen 娀 Baby Boomer猀 15% 10% Gen 堀 29% Millennial猀 46% ⨀ Based on data between July 2023 - June 202㐀 㐀 Gen Z: 1997 - 2012, Millennials: 1981 - 1996,†⠀ Gen X (1965 - 1980), Baby Boomers+ (before 1964⤀ * Based on share of unique users A昀昀irm’s consumer base is reflective of the U.S. population, with users from the top five most populated states in the nation comprising over 40% of A昀昀irm’s active users in FY’24. Notably, A昀昀irm has consumers in every U.S. state. 2,435,836 * Based on data betwee渠⠀ July 2023 - June 202㐀 * Based on unique users 664 We believe we can improve lives through responsible lending. A昀昀irm’s products are widely available—anyone with access to the Internet, regardless of their personal economic circumstances, may apply for an A昀昀irm loan to complete a purchase. Moreover, A昀昀irm empowers consumers by o昀昀ering a transparent and flexible way to pay over time with no late or hidden fees and the ability to pay at their own pace in incremental payments with simple (as opposed to compounding) interest. A昀昀irm’s success is fundamentally aligned with consumers: we win when they win. 2024 ESG REPORT 22

2024 ESG Report Page 21 Page 23

2024 ESG Report Page 21 Page 23