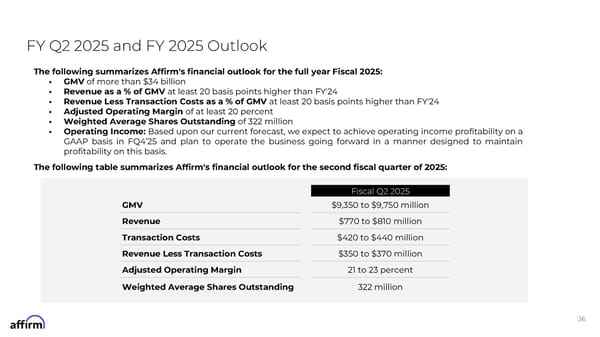

FY Q2 2025 and FY 2025 Outlook The following summarizes Affirm's financial outlook for the full year Fiscal 2025: " GMV of more than $34 billion " Revenue as a % of GMV at least 20 basis points higher than FY'24 " Revenue Less Transaction Costs as a % of GMV at least 20 basis points higher than FY'24 " Adjusted Operating Margin of at least 20 percent " Weighted Average Shares Outstanding of 322 million " Operating Income: Based upon our current forecast, we expect to achieve operating income profitability on a GAAP basis in FQ4925 and plan to operate the business going forward in a manner designed to maintain profitability on this basis. The following table summarizes Affirm's financial outlook for the second fiscal quarter of 2025: Fiscal Q2 2025 GMV $9,350 to $9,750 million Revenue $770 to $810 million Transaction Costs $420 to $440 million Revenue Less Transaction Costs $350 to $370 million Adjusted Operating Margin 21 to 23 percent Weighted Average Shares Outstanding 322 million 36

FY Q1'25 Earnings Supplement Page 35 Page 37

FY Q1'25 Earnings Supplement Page 35 Page 37