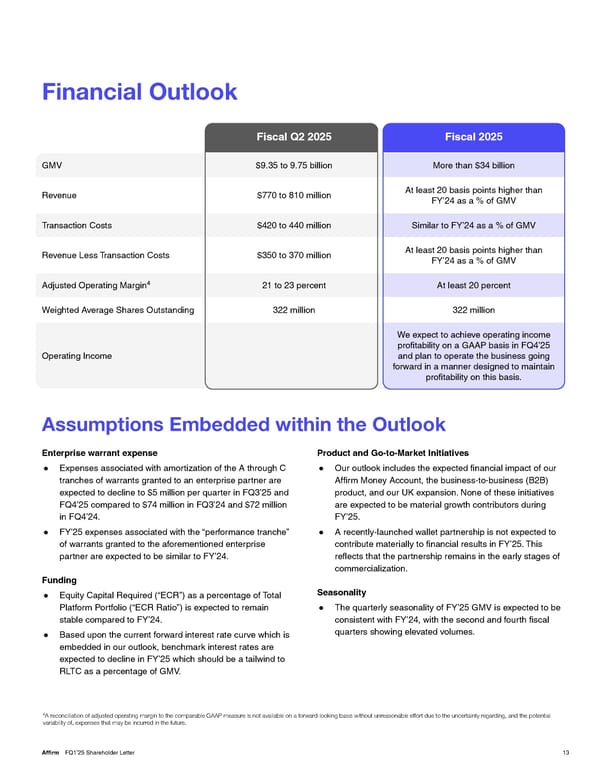

Financial Outlook Fiscal Q2 2025 Fiscal 2025 GMV $9.35 to 9.75 billion More than $34 billion At least 20 basis points higher than Revenue $770 to 810 million FY’24 as a % of GMV Transaction Costs $420 to 440 million Similar to FY’24 as a % of GMV At least 20 basis points higher than Revenue Less Transaction Costs $350 to 370 million FY’24 as a % of GMV 4 Adjusted Operating Margin 21 to 23 percent At least 20 percent Weighted Average Shares Outstanding 322 million 322 million We expect to achieve operating income proûtability on a GAAP basis in FQ4’25 Operating Income and plan to operate the business going forward in a manner designed to maintain proûtability on this basis. Assumptions Embedded within the Outlook Enterprise warrant expense Product and Go-to-Market Initiatives ● Our outlook includes the expected ûnancial impact of our ● Expenses associated with amortization of the A through C tranches of warrants granted to an enterprise partner are Afûrm Money Account, the business-to-business (B2B) product, and our UK expansion. None of these initiatives expected to decline to $5 million per quarter in FQ3’25 and are expected to be material growth contributors during FQ4’25 compared to $74 million in FQ3’24 and $72 million FY’25. in FQ4’24. ● A recently-launched wallet partnership is not expected to ● FY’25 expenses associated with the

Shareholder Letter Page 12 Page 14

Shareholder Letter Page 12 Page 14