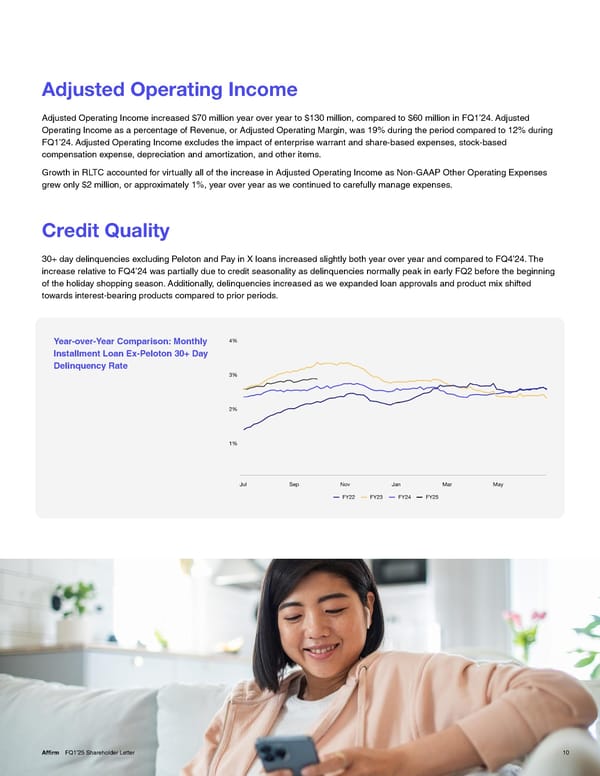

Adjusted Operating Income Adjusted Operating Income increased $70 million year over year to $130 million, compared to $60 million in FQ1’24. Adjusted Operating Income as a percentage of Revenue, or Adjusted Operating Margin, was 19% during the period compared to 12% during FQ1’24. Adjusted Operating Income excludes the impact of enterprise warrant and share-based expenses, stock-based compensation expense, depreciation and amortization, and other items. Growth in RLTC accounted for virtually all of the increase in Adjusted Operating Income as Non-GAAP Other Operating Expenses grew only $2 million, or approximately 1%, year over year as we continued to carefully manage expenses. Credit Quality 30+ day delinquencies excluding Peloton and Pay in X loans increased slightly both year over year and compared to FQ4’24. The increase relative to FQ4’24 was partially due to credit seasonality as delinquencies normally peak in early FQ2 before the beginning of the holiday shopping season. Additionally, delinquencies increased as we expanded loan approvals and product mix shifted towards interest-bearing products compared to prior periods. Year-over-Year Comparison: Monthly Installment Loan Ex-Peloton 30+ Day Delinquency Rate Affirm FQ1’25 Shareholder Letter 10

Shareholder Letter Page 9 Page 11

Shareholder Letter Page 9 Page 11