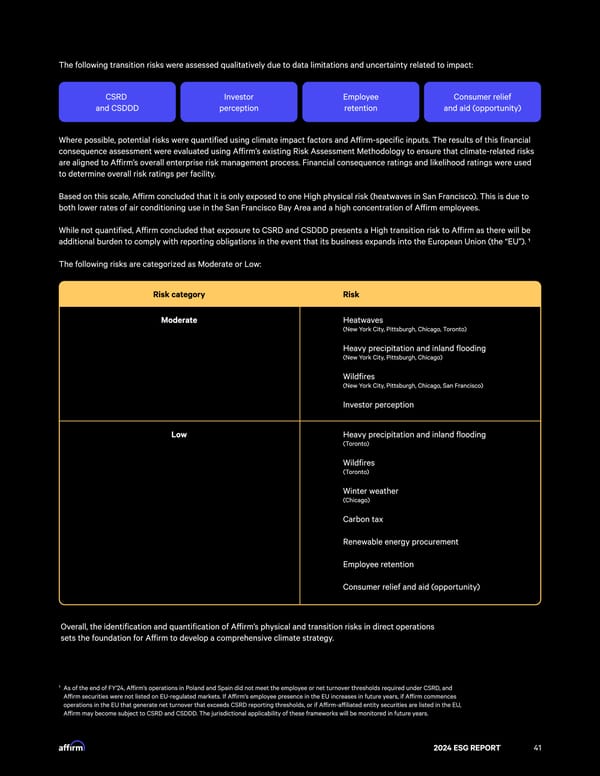

The following transition risks were assessed qualitatively due to data limitations and uncertainty related to impact: CSRD†⠀ Investo爠⠀ Employe攀 Consumer relie昀 and CSDDD perception retention and aid (opportunity) Where possible, potential risks were quantified using climate impact factors and A昀昀irm-specific inputs. The results of this financial consequence assessment were evaluated using A昀昀irm’s existing Risk Assessment Methodology to ensure that climate-related risks are aligned to A昀昀irm’s overall enterprise risk management process. Financial consequence ratings and likelihood ratings were used to determine overall risk ratings per facility.⨀ Based on this scale, A昀昀irm concluded that it is only exposed to one High physical risk (heatwaves in San Francisco). This is due to both lower rates of air conditioning use in the San Francisco Bay Area and a high concentration of A昀昀irm employees.⨀ While not quantified, A昀昀irm concluded that exposure to CSRD and CSDDD presents a High transition risk to A昀昀irm as there will be additional burden to comply with reporting obligations in the event that its business expands into the European Union (the “EU”). 㬀 The following risks are categorized as Moderate or Low: Risk category Risk Moderate Heatwavesꀀ (New York City, Pittsburgh, Chicago, Toronto㌀ Heavy precipitation and inland floodingꀀ (New York City, Pittsburgh, Chicago㌀ Wildfiresꀀ (New York City, Pittsburgh, Chicago, San Francisco㌀ Investor perception Low Heavy precipitation and inland floodingꀀ (Toronto㌀ Wildfiresꀀ (Toronto㌀ Winter weatherꀀ (Chicago㌀ Carbon ta舀 Renewable energy procuremen縀 Employee retentio砀 Consumer relief and aid (opportunity) Overall, the identification and quantification of A昀昀irm’s physical and transition risks in direct operations sets the foundation for A昀昀irm to develop a comprehensive climate strategy. 1 As of the end of FY’24, A昀昀irm’s operations in Poland and Spain did not meet the employee or net turnover thresholds required under CSRD, and A昀昀irm securities were not listed on EU-regulated markets. If A昀昀irm's employee presence in the EU increases in future years, if A昀昀irm commences operations in the EU that generate net turnover that exceeds CSRD reporting thresholds, or if A昀昀irm-a昀昀iliated entity securities are listed in the EU, A昀昀irm may become subject to CSRD and CSDDD. The jurisdictional applicability of these frameworks will be monitored in future years. 2024 ESG REPORT 41

2024 ESG Report Page 40 Page 42

2024 ESG Report Page 40 Page 42