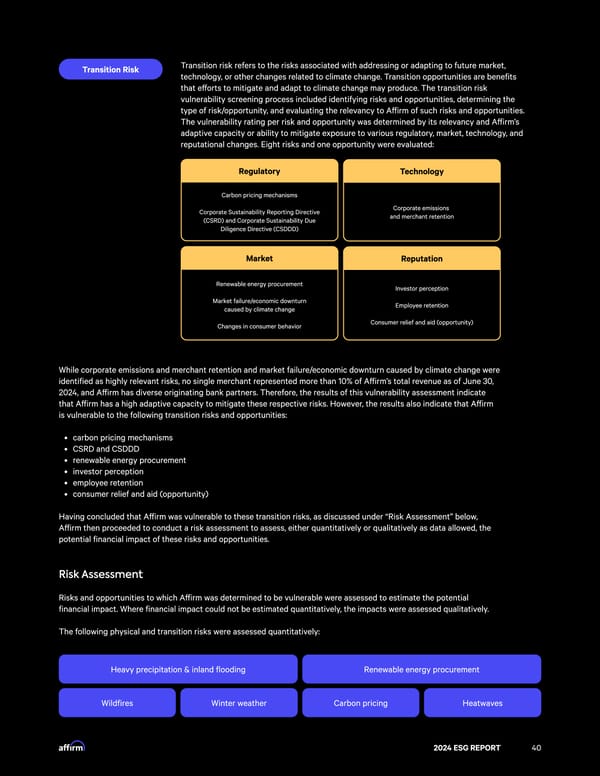

Transition risk refers to the risks associated with addressing or adapting to future market, Transition Risk technology, or other changes related to climate change. Transition opportunities are benefits that e昀昀orts to mitigate and adapt to climate change may produce. The transition risk vulnerability screening process included identifying risks and opportunities, determining the type of risk/opportunity, and evaluating the relevancy to A昀昀irm of such risks and opportunities. The vulnerability rating per risk and opportunity was determined by its relevancy and A昀昀irm’s adaptive capacity or ability to mitigate exposure to various regulatory, market, technology, and reputational changes. Eight risks and one opportunity were evaluated: Regulatory Technology Carbon pricing mechanism紀 Corporate emissions†⠀ Corporate Sustainability Reporting Directive and merchant retention (CSRD) and Corporate Sustainability Due Diligence Directive (CSDDD) Market Reputation Renewable energy procuremen縀 Investor perceptio砀 Market failure/economic downtur渠⠀ Employee retentio砀 caused by climate chang漀 Consumer relief and aid (opportunity) Changes in consumer behavior While corporate emissions and merchant retention and market failure/economic downturn caused by climate change were identified as highly relevant risks, no single merchant represented more than 10% of A昀昀irm’s total revenue as of June 30, 2024, and A昀昀irm has diverse originating bank partners. Therefore, the results of this vulnerability assessment indicate that A昀昀irm has a high adaptive capacity to mitigate these respective risks. However, the results also indicate that A昀昀irm is vulnerable to the following transition risks and opportunities carbon pricing mechanism CSRD and CSDD renewable energy procuremen investor perceptio employee retentio consumer relief and aid (opportunity) ꨀ Having concluded that A昀昀irm was vulnerable to these transition risks, as discussed under “Risk Assessment” below, A昀昀irm then proceeded to conduct a risk assessment to assess, either quantitatively or qualitatively as data allowed, the potential financial impact of these risks and opportunities. Risk Assessmen縀 Risks and opportunities to which A昀昀irm was determined to be vulnerable were assessed to estimate the potential financial impact. Where financial impact could not be estimated quantitatively, the impacts were assessed qualitatively.⨀ The following physical and transition risks were assessed quantitatively: Heavy precipitation & inland flooding Renewable energy procurement Wildfires Winter weather Carbon pricing Heatwaves 2024 ESG REPORT 40

2024 ESG Report Page 39 Page 41

2024 ESG Report Page 39 Page 41