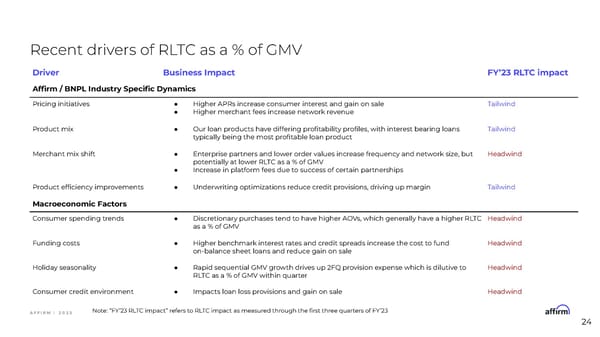

Recent drivers of RLTC as a % of GMV Driver Business Impact FY’23 RLTC impact Affirm / BNPL Industry Specific Dynamics Pricing initiatives ● Higher APRs increase consumer interest and gain on sale Tailwind ● Higher merchant fees increase network revenue Product mix ● Our loan products have differing proûtability proûles, with interest bearing loans Tailwind typically being the most proûtable loan product Merchant mix shift ● Enterprise partners and lower order values increase frequency and network size, but Headwind potentially at lower RLTC as a % of GMV ● Increase in platform fees due to success of certain partnerships Product efûciency improvements ● Underwriting optimizations reduce credit provisions, driving up margin Tailwind Macroeconomic Factors Consumer spending trends ● Discretionary purchases tend to have higher AOVs, which generally have a higher RLTC Headwind as a % of GMV Funding costs ● Higher benchmark interest rates and credit spreads increase the cost to fund Headwind on-balance sheet loans and reduce gain on sale Holiday seasonality ● Rapid sequential GMV growth drives up 2FQ provision expense which is dilutive to Headwind RLTC as a % of GMV within quarter Consumer credit environment ● Impacts loan loss provisions and gain on sale Headwind Note:

Affirm Financial Model Information Session Page 23 Page 25

Affirm Financial Model Information Session Page 23 Page 25