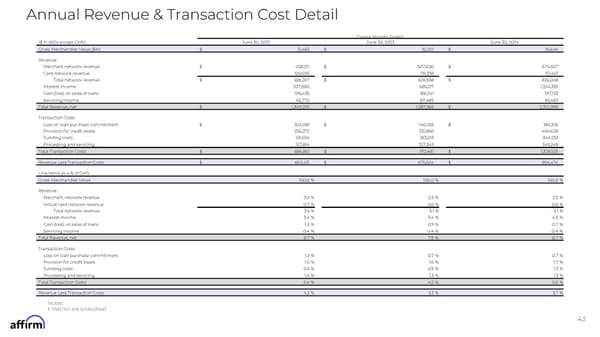

Annual Revenue & Transaction Cost Detail Twelve Months Ended: ($ in 000s except GMV) June 30, 2022 June 30, 2023 June 30, 2024 Gross Merchandise Value ($M) $ 15,483 $ 20,201 $ 26,646 Revenue Merchant network revenue $ 458,511 $ 507,600 $ 674,607 Card network revenue 100,696 119,338 151,401 Total network revenue $ 559,207 $ 626,938 $ 826,008 Interest income 527,880 685,217 1,204,355 Gain (loss) on sales of loans 196,435 188,341 197,153 Servicing income 65,770 87,489 95,483 Total Revenue, net $ 1,349,292 $ 1,587,985 $ 2,322,999 Transaction Costs Loss on loan purchase commitment $ 204,081 $ 140,265 $ 180,395 Provision for credit losses 255,272 331,860 460,628 Funding costs 69,694 183,013 344,253 Processing and servicing 157,814 257,343 343,249 Total Transaction Costs $ 686,861 $ 912,481 $ 1,328,525 Revenue Less Transaction Costs $ 662,431 $ 675,504 $ 994,474 Line Items as a % of GMV Gross Merchandise Value 100.0 % 100.0 % 100.0 % Revenue Merchant network revenue 3.0 % 2.5 % 2.5 % Virtual card network revenue 0.7 % 0.6 % 0.6 % Total network revenue 3.6 % 3.1 % 3.1 % Interest income 3.4 % 3.4 % 4.5 % Gain (loss) on sales of loans 1.3 % 0.9 % 0.7 % Servicing income 0.4 % 0.4 % 0.4 % Total Revenue, net 8.7 % 7.9 % 8.7 % Transaction Costs Loss on loan purchase commitment 1.3 % 0.7 % 0.7 % Provision for credit losses 1.6 % 1.6 % 1.7 % Funding costs 0.5 % 0.9 % 1.3 % Processing and servicing 1.0 % 1.3 % 1.3 % Total Transaction Costs 4.4 % 4.5 % 5.0 % Revenue Less Transaction Costs 4.3 % 3.3 % 3.7 % Notes: 1. Metrics are unaudited 43

FY Q1'25 Earnings Supplement Page 42 Page 44

FY Q1'25 Earnings Supplement Page 42 Page 44