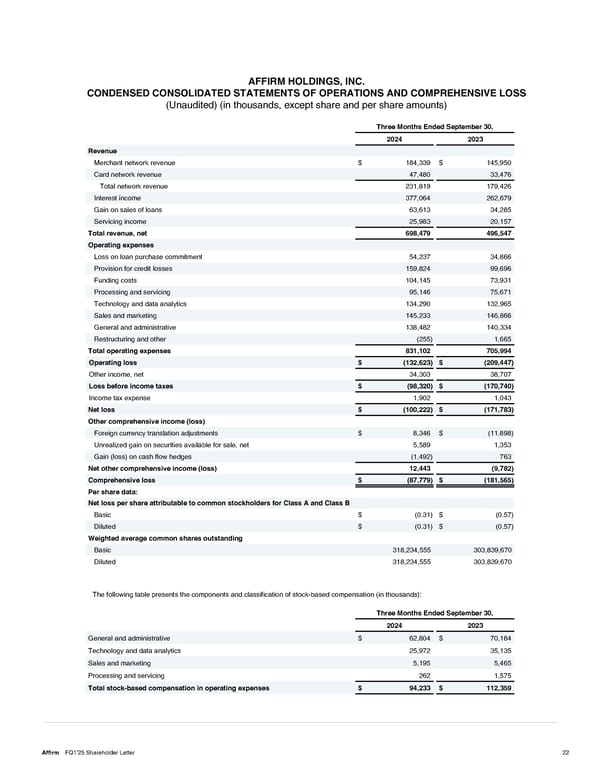

AFFIRM HOLDINGS, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (Unaudited) (in thousands, except share and per share amounts) Three Months Ended September 30, 2024 2023 Revenue Merchant network revenue $ 184,339 $ 145,950 Card network revenue 47,480 33,476 Total network revenue 231,819 179,426 Interest income 377,064 262,679 Gain on sales of loans 63,613 34,285 Servicing income 25,983 20,157 Total revenue, net 698,479 496,547 Operating expenses Loss on loan purchase commitment 54,237 34,866 Provision for credit losses 159,824 99,696 Funding costs 104,145 73,931 Processing and servicing 95,146 75,671 Technology and data analytics 134,290 132,965 Sales and marketing 145,233 146,866 General and administrative 138,482 140,334 Restructuring and other (255) 1,665 Total operating expenses 831,102 705,994 Operating loss $ (132,623) $ (209,447) Other income, net 34,303 38,707 Loss before income taxes $ (98,320) $ (170,740) Income tax expense 1,902 1,043 Net loss $ (100,222) $ (171,783) Other comprehensive income (loss) Foreign currency translation adjustments $ 8,346 $ (11,898) Unrealized gain on securities available for sale, net 5,589 1,353 Gain (loss) on cash flow hedges (1,492) 763 Net other comprehensive income (loss) 12,443 (9,782) Comprehensive loss $ (87,779) $ (181,565) Per share data: Net loss per share attributable to common stockholders for Class A and Class B Basic $ (0.31) $ (0.57) Diluted $ (0.31) $ (0.57) Weighted average common shares outstanding Basic 318,234,555 303,839,670 Diluted 318,234,555 303,839,670 The following table presents the components and classification of stock-based compensation (in thousands): Three Months Ended September 30, 2024 2023 General and administrative $ 62,804 $ 70,184 Technology and data analytics 25,972 35,135 Sales and marketing 5,195 5,465 Processing and servicing 262 1,575 Total stock-based compensation in operating expenses $ 94,233 $ 112,359 Affirm FQ1’25 Shareholder Letter 22

Shareholder Letter Page 21 Page 23

Shareholder Letter Page 21 Page 23