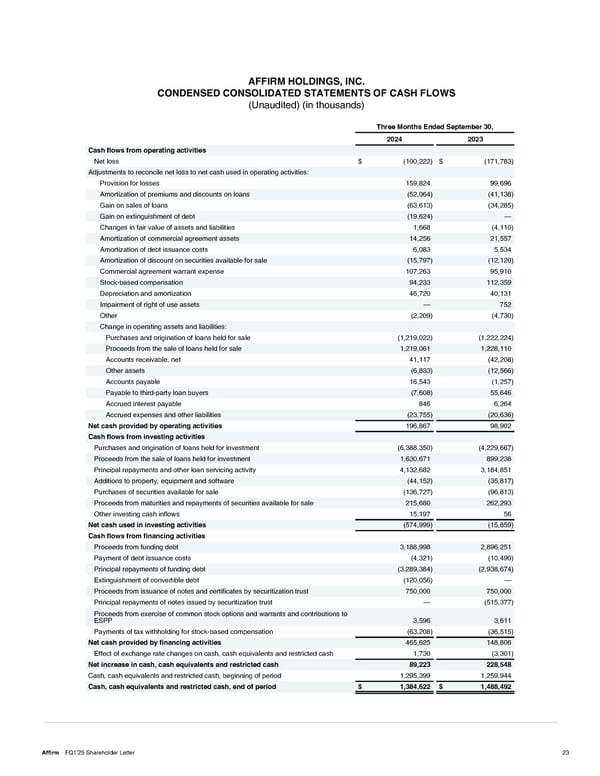

AFFIRM HOLDINGS, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (in thousands) Three Months Ended September 30, 2024 2023 Cash flows from operating activities Net loss $ (100,222) $ (171,783) Adjustments to reconcile net loss to net cash used in operating activities: Provision for losses 159,824 99,696 Amortization of premiums and discounts on loans (52,064) (41,138) Gain on sales of loans (63,613) (34,285) Gain on extinguishment of debt (19,624) 4 Changes in fair value of assets and liabilities 1,668 (4,110) Amortization of commercial agreement assets 14,256 21,557 Amortization of debt issuance costs 6,083 5,534 Amortization of discount on securities available for sale (15,797) (12,120) Commercial agreement warrant expense 107,263 95,910 Stock-based compensation 94,233 112,359 Depreciation and amortization 46,720 40,131 Impairment of right of use assets 4 752 Other (2,209) (4,730) Change in operating assets and liabilities: Purchases and origination of loans held for sale (1,219,022) (1,222,224) Proceeds from the sale of loans held for sale 1,219,061 1,228,110 Accounts receivable, net 41,117 (42,208) Other assets (6,833) (12,566) Accounts payable 16,543 (1,257) Payable to third-party loan buyers (7,608) 55,646 Accrued interest payable 846 6,264 Accrued expenses and other liabilities (23,755) (20,636) Net cash provided by operating activities 196,867 98,902 Cash flows from investing activities Purchases and origination of loans held for investment (6,388,350) (4,229,667) Proceeds from the sale of loans held for investment 1,630,671 899,238 Principal repayments and other loan servicing activity 4,132,682 3,184,851 Additions to property, equipment and software (44,152) (35,817) Purchases of securities available for sale (136,727) (96,813) Proceeds from maturities and repayments of securities available for sale 215,680 262,293 Other investing cash inflows 15,197 56 Net cash used in investing activities (574,999) (15,859) Cash flows from financing activities Proceeds from funding debt 3,188,998 2,896,251 Payment of debt issuance costs (4,321) (10,490) Principal repayments of funding debt (3,289,384) (2,938,674) Extinguishment of convertible debt (120,056) 4 Proceeds from issuance of notes and certificates by securitization trust 750,000 750,000 Principal repayments of notes issued by securitization trust 4 (515,377) Proceeds from exercise of common stock options and warrants and contributions to ESPP 3,596 3,611 Payments of tax withholding for stock-based compensation (63,208) (36,515) Net cash provided by financing activities 465,625 148,806 Effect of exchange rate changes on cash, cash equivalents and restricted cash 1,730 (3,301) Net increase in cash, cash equivalents and restricted cash 89,223 228,548 Cash, cash equivalents and restricted cash, beginning of period 1,295,399 1,259,944 Cash, cash equivalents and restricted cash, end of period $ 1,384,622 $ 1,488,492 Affirm FQ1’25 Shareholder Letter 23

Shareholder Letter Page 22 Page 24

Shareholder Letter Page 22 Page 24