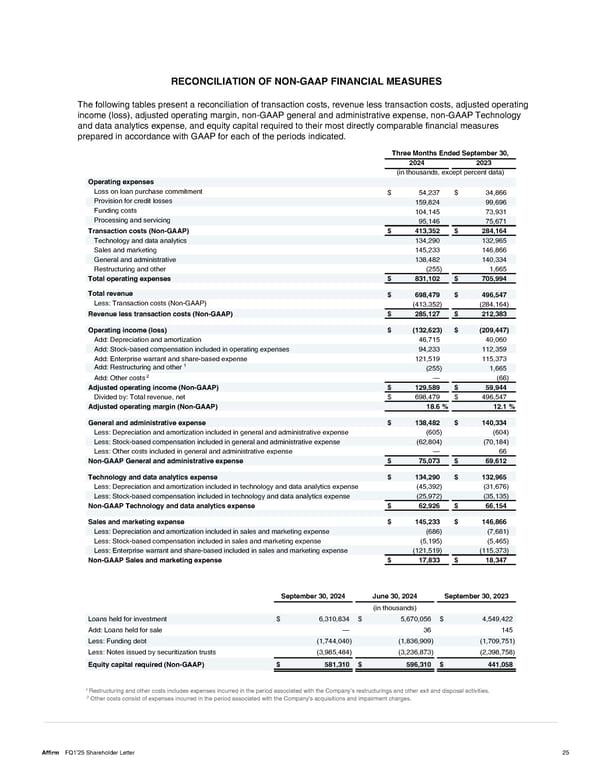

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES The following tables present a reconciliation of transaction costs, revenue less transaction costs, adjusted operating income (loss), adjusted operating margin, non-GAAP general and administrative expense, non-GAAP Technology and data analytics expense, and equity capital required to their most directly comparable financial measures prepared in accordance with GAAP for each of the periods indicated. Three Months Ended September 30, 2024 2023 (in thousands, except percent data) Operating expenses Loss on loan purchase commitment $ 54,237 $ 34,866 Provision for credit losses 159,824 99,696 Funding costs 104,145 73,931 Processing and servicing 95,146 75,671 Transaction costs (Non-GAAP) $ 413,352 $ 284,164 Technology and data analytics 134,290 132,965 Sales and marketing 145,233 146,866 General and administrative 138,482 140,334 Restructuring and other (255) 1,665 Total operating expenses $ 831,102 $ 705,994 Total revenue $ 698,479 $ 496,547 Less: Transaction costs (Non-GAAP) (413,352) (284,164) Revenue less transaction costs (Non-GAAP) $ 285,127 $ 212,383 Operating income (loss) $ (132,623) $ (209,447) Add: Depreciation and amortization 46,715 40,060 Add: Stock-based compensation included in operating expenses 94,233 112,359 Add: Enterprise warrant and share-based expense 121,519 115,373 1 Add: Restructuring and other (255) 1,665 2 Add: Other costs 4 (66) Adjusted operating income (Non-GAAP) $ 129,589 $ 59,944 Divided by: Total revenue, net $ 698,479 $ 496,547 Adjusted operating margin (Non-GAAP) 18.6 % 12.1 % General and administrative expense $ 138,482 $ 140,334 Less: Depreciation and amortization included in general and administrative expense (605) (604) Less: Stock-based compensation included in general and administrative expense (62,804) (70,184) Less: Other costs included in general and administrative expense 4 66 Non-GAAP General and administrative expense $ 75,073 $ 69,612 Technology and data analytics expense $ 134,290 $ 132,965 Less: Depreciation and amortization included in technology and data analytics expense (45,392) (31,676) Less: Stock-based compensation included in technology and data analytics expense (25,972) (35,135) Non-GAAP Technology and data analytics expense $ 62,926 $ 66,154 Sales and marketing expense $ 145,233 $ 146,866 Less: Depreciation and amortization included in sales and marketing expense (686) (7,681) Less: Stock-based compensation included in sales and marketing expense (5,195) (5,465) Less: Enterprise warrant and share-based included in sales and marketing expense (121,519) (115,373) Non-GAAP Sales and marketing expense $ 17,833 $ 18,347 September 30, 2024 June 30, 2024 September 30, 2023 (in thousands) Loans held for investment $ 6,310,834 $ 5,670,056 $ 4,549,422 Add: Loans held for sale 4 36 145 Less: Funding debt (1,744,040) (1,836,909) (1,709,751) Less: Notes issued by securitization trusts (3,985,484) (3,236,873) (2,398,758) Equity capital required (Non-GAAP) $ 581,310 $ 596,310 $ 441,058 1 Restructuring and other costs includes expenses incurred in the period associated with the Company's restructurings and other exit and disposal activities. 2 Other costs consist of expenses incurred in the period associated with the Company's acquisitions and impairment charges. Affirm FQ1’25 Shareholder Letter 25

Shareholder Letter Page 24 Page 26

Shareholder Letter Page 24 Page 26