2024 ESG Report

This document is Affirm's 2024 Environmental, Social, and Governance (ESG) Report.

Table of contents 03 Message from our Founder and CEO, Max Levchin 04 About A昀昀irm 0㐀 Who we ar攀 05 Key performance highlights 04 Why we’re here 06 A昀昀irm’s ESG strategy: Simpler is better 07 A昀昀irm’s first materiality assessment: No fine print 09 Governance: It’s on us 0㤀 ESG program governanc攀 1㐀 Stockholder engagemen琀 1 Board oversight of ES䜀 1㔀 Information securit礀 1 Board diversit礀 1㘀 Data privac礀 1㈀ Management diversit礀 16 Cybersecurity 13 Stakeholder engagement 20 Social responsibility: People come first 2㨀 Financial inclusion and 2㠀 Diversity, equity, and inclusion at A昀昀ir洀 socioeconomic empowermen琀 3 Compensatio渀 2㌀ Customer experienc攀 3 Benefit猀 2㐀 Financial literacy and community impac琀 3㈀ Training and developmen琀 2㔀 Code of Conduc琀 3㌀ Performance managemen琀 2㘀 Human right猀 34 Employee satisfaction and engagement 26 Health and safety 35 Environmental impact & sustainability: Push the envelope 3㔀 Energy e昀昀icienc礀 3㜀 Waste management 3㔀 Environmental footprin琀 3㠀 Water managemen琀 36 Our operational GHG emissions footprint 39 2024 Climate-related risk and opportunity screening ESG Report terminolog茀 Incorporation by referenceꨀ Terms used in this Environmental, Social, and Governance (“ESG”) Report, such as “significance” All website addresses contained in this report are intended to and “material” and variations thereof, are intended to be used only within the context of our ESG provide inactive, textual references only. The content on, or strategies, activities, progress, metrics, and performance. Such terms are distinct from, and do not accessible through, any website identified in this report is not a refer to, concepts used in securities or other applicable law, and the use of such terms is not an part of, and is not incorporated by reference into, this report or in indication that A昀昀irm deems related information to be significant, material, or otherwise important any report or document that we file with the Securities and to an understanding of its business or an investment decision with regard to A昀昀irm securities. Exchange Commission. 2024 ESG REPORT 2

Message from our Founder and CEO, Max Levchin At A昀昀irm, our mission is to deliver honest financial products that improve lives. This mission has guided our work for more than a decade, as we built a scalable, sustainable business to stand the test of time.ꨀ Corporate sustainability is an important consideration in how we do business, from how we develop products and services that empower consumers, to the way we support employees and give back to our communities. Last year, we introduced A昀昀irm’s first ever Environmental, Social, and Governance (“ESG”) Report that detailed our strategy, program governance, and accomplishments under each pillar of ESG. This year, we are pleased to share an update on the progress of our program. Some of the highlights from this year include: We improved our emissions data collection processes and refined our Scope 1 (direct) and Scope 2 (indirect) greenhouse gas emissions for the 2023 fiscal year. We also calculated and disclosed our Scope 3 emissions for the first time. These e昀昀orts demonstrate our commitment to environmental awareness, and the results validate the environmental sustainability of our operating model. We conducted an extensive screening to identify and assess climate-related risks and opportunities that might impact our operations and consumers in North America. The results of that screening indicate that A昀昀irm does not currently face any material climate-related risks We continued to promote transparency for both current and prospective A昀昀irmers. In November 2023,†⠀ we published geographic di昀昀erentials, pay grades, and pay structures for every job at the company.†⠀ We believe this level of transparency inspires confidence in our compensation decisions, builds trust amongst our team, and attracts new, talented A昀昀irmers to join our mission. I am truly grateful to the hard-working A昀昀irmers who have put this company on such a strong trajectory for the future. We look forward to providing additional updates as we advance on our sustainability journey ⡖ OnwardⰀ Max Levchin 2024 ESG REPORT 3

About A昀케rm Who we ar漀 A昀昀irm was founded in 2012 with a mission to deliver honest financial products that improve lives. We are building the next-generation platform for digital and mobile-first commerce. We believe that by using modern technology, strong engineering talent, and a mission-driven approach, we can reinvent payments and commerce. Our solutions, which are built on trust and transparency, are designed to make it easier for consumers to spend responsibly and with confidence, easier for merchants and commerce platforms to convert sales and grow, and easier for commerce to thrive. Why we’re here To help consumers on their term紀 $0 in late fees in over 10 years Some financial products have historically benefited at consumers’ expense: prolonging and maximizing time in debt and charging fees without adding value. A昀昀irm took a long, hard look at the old system and knew that there had to be a better way. So we built it. A昀昀irm empowers consumers by o昀昀ering a transparent and flexible way to pay over time with no late or hidden fees. We provide consumers with increased purchasing power and greater control over managing their 1 18.7 million Active Consumers finances. We enable eligible consumers to pay on their terms in biweekly or monthly payments, rather than entirely up front. The interest-bearing transactions we facilitate only include simple interest. This means that the interest is based upon a fixed percentage the consumer agrees to up front at checkout and it never compounds. Consumers who choose A昀昀irm never owe a penny more than what they agreed to on day one, even if they’re late or miss a payment. 300,000+ Active Merchants To help merchant紀 A昀昀irm helps merchants of all sizes drive growth and better serve their customers. We’ve proven that we can increase sales and introduce new consumers to our merchant partners. That’s why our partners include household-name brands across home, 2023 Newsweek’s Most Trusted lifestyle, fashion, beauty, travel, fitness, auto service and parts, Companies in Americ欀 and more. This network is further bolstered by the A昀昀irm app, A昀昀irm ranked 6th out of 44 companies in th攠⠀ which gives consumers a convenient way to use A昀昀irm as an financial services industry in customer trust omnichannel payment method, while providing a marketplace for merchants to reach consumers. All figures presented in this Report are as of June 30, 2024 unless otherwise note渀 1 Active Consumers defined as consumers who engage in at least one transaction on A昀昀irm’s platform during the 12 months prior to the measurement date. 2024 ESG REPORT 4

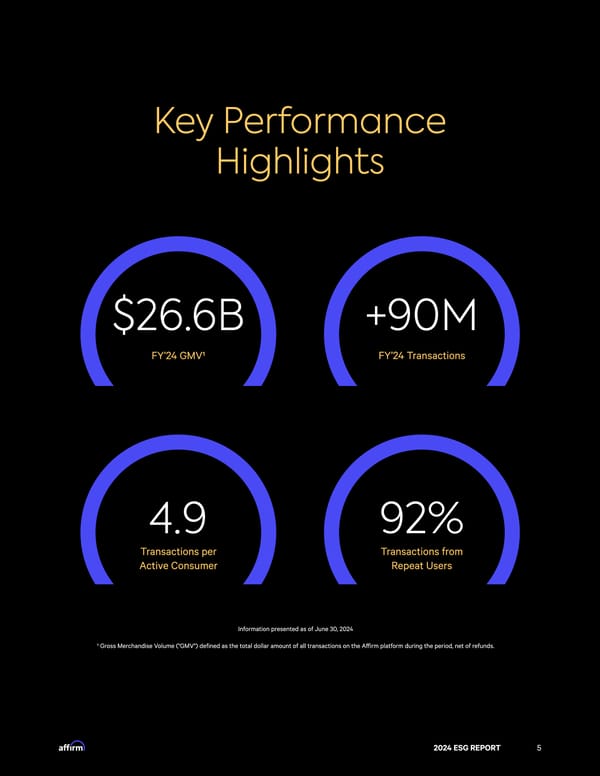

Key Performance Highlights $26.6B +90M FY’24 Transactions FY’24 GMV1 4.9 92% Transactions pe爀 Transactions fro洀 Active Consumer Repeat Users Information presented as of June 30, 202㸀 1 Gross Merchandise Volume ("GMV") defined as the total dollar amount of all transactions on the A昀昀irm platform during the period, net of refunds. 2024 ESG REPORT 5

A昀케rm’s ESG strategy: Simpler is better Sustainably advancing our mission to improve live紀 At A昀昀irm, our mission is to deliver honest financial products that improve lives. Our purpose is not solely to improve the lives of consumers, merchants, stockholders, and our employees, but also the communities in which we operate. Our business strategy is supported by our core values: Simpler is better; No fine print; It’s on us; People come first; and Push the envelope.ꨀ Our ESG strategy directly aligns with these core values: Simpler is better It’s on us We make complex things simple and clear. Which is We take full accountability for our actions, never shirking why we will always strive to e昀昀ectively communicate responsibility or passing the buck. We view good governance our ESG strategy, including our objectives and progress as foundational to our ESG program as it promotes accountability toward those objectives, in a clear, concise, and easily in our e昀昀orts to make a positive social impact and to minimize understandable manner. our impact on the environment. No昀椀neprint Peoplecome昀椀rst We are completely transparent and honest—with our We consider our impact on people’s lives before we stakeholders and with each other. If we view an ESG metric think about our own interests. This means we align our as important, we will work toward disclosing it t漠⠀ success with the success of our consumers, merchants, our stakeholders. A昀昀irmers, and the communities in which we do business. Pushtheenvelope We never stop innovating, taking smart risks, and raising the bar. We actively manage our environmental impact across our facilities, which includes practices and partnerships focused on addressing climate change, sustainably managing resources, and mitigating our environmental impact. 2024 ESG REPORT 6

A昀케rm’s 昀椀rst materiality No 昀椀ne print assessment: In April 2023, A昀昀irm conducted its first materiality assessment, which was designed to identify ESG topics that are most important to our business and stakeholders. Informed by both internal and external stakeholder feedback, a team of A昀昀irmers (comprising our ESG Working Group) identified 14 significant ESG topics, of which five were selected as most important to A昀昀irm’s business and stakeholders. Our methodology Stakeholde爀 Material topic opi挀 T engagemen縀 prioritizatio砀 tio砀 a identific We conducted interviews with the We then summarized the results from d, and e d, analyz e enchmark e b W ESG Working Group to identify the each topic prioritization activity and d on s base opic ant t v ele d r identifie most important issues to their developed an ESG materiality matrix that s, ompanie er c e om p s fr ort ep ESG r individual corporate function and will help prioritize our ESG strategy and ends, and global industry tr their individual key stakeholders. disclosures going forward. s. amework orting fr ep y r ainabilit sust 2024 ESG REPORT 7

Key observation紀 We identified five topics across the social and governance categories that are considered to be most important to A昀昀irm: Transparency: A昀昀irm is committed to providing accurate and complete disclosures to both internal and external stakeholder groups Financial literacy and inclusion: A昀昀irm views this topic as important because it supports e昀昀orts “to deliver honest financial products that improve lives” and ameliorates regulatory concern and feedback around A昀昀irm’s product o昀昀erings, among other factors Diversity, equity, and inclusion: A昀昀irm is committed to building a diverse and engaged community. A昀昀irm has ongoing initiatives and established priorities aimed at enhancing employee engagement and promoting diversity at every level of the business. Business ethics: Under our Code of Ethics and Business Conduct, our employees, o昀昀icers, and directors are held to the highest levels of ethical behavior and integrity. Merchant partnership and engagement: A昀昀irm is focused on building strong merchant and vendor partnerships. Closely aligned with the company’s DE&I e昀昀orts, A昀昀irm continues to invest in and create intentional outreach e昀昀orts that are designed to increase its merchant base, support merchant engagement, and improve merchant diversity e昀昀orts. e Transparency anc ort d Imp ablishe Diversity, Equity, Inclusion st E Financial Literacy and Inclusion G Merchant Partnership and Engagement o EW Business Ethics t e anc t mpor I e anc ort ging Imp Emer Emerging Importance Established Importance Importance to A昀케rm as a Business Environmental Governance Social We expect to leverage the results of this materiality assessment, as well as feedback from future stakeholder engagement, to help guide the evolution of our ESG program. 2024 ESG REPORT 8

Governance: It’s On Us We believe that good governance drives the creation and preservation of value for our stockholders and other stakeholders. This includes a comprehensive approach to corporate governance that not only complies with all applicable laws, rules, regulations, and policies, but also demonstrates an unwavering commitment to our core values㠀 Our overall governance framework is designed to drive strong oversight, create accountability at the Board of Directors (“Board”) and management levels, and demonstrate our commitment to transparency, independence, and diversity. We seek to apply the same approach to the oversight, management, and implementation of our ESG strategy.ꨀ Our commitment to strong corporate governance is detailed in our most recent Proxy Statement, which provides detailed disclosure on our Board structure and composition, risk oversight, stockholder engagement, executive compensation, and other key governance topics. ESG program governanc漀 Our ESG program has representation from all levels of our company, including our Board, senior management, and employees who have a passion for building a sustainable future. Board of Director紀 At the Board level, our Nominating and Governance Committee oversees our ESG program, generally, with our Compensation Committee providing oversight on key elements of the social pillar of our ESG program. ESG Steering Committe漀 Our ESG Steering Committee, which is comprised of senior members of our management team, oversees our ESG strategy, policies, and objectives. The Steering Committee meets as needed to evolve our ESG strategy, set objectives, budgets, and implementation timelines and monitor progress and results of our ESG program. ESG Working Grou稀 Our ESG Working Group consists of A昀昀irmers across various functions within the organization. The Working Group is responsible for implementing the strategy, policies, and objectives established by the Steering Committee⸀ 2024 ESG REPORT 9

Oversight: Our Board, through its†⠀ ESG Working Group committees, plays an active role in ESG matters†⠀ that impact A昀昀irm’s business ESG Steering Committee Nominating and Governance Committee: Oversees Oversight our ESG program except for certain strategies and policies relating to human capital management Nominating ☀ Audi琀 Compensation Committee: Oversees elements of our Governanc攀 Commitee Committee ESG program relating to human capital management A昀昀ir洀 Audit Committee: Oversees, among other things,†⠀ Board o昀 Directors the integrity of our information technology†⠀ systems, processes, and data as well as related cybersecurity matters㠀 Compensatio渀 Committee Management: Our management team, through the ESG Steering Committee, directs and manages the execution†⠀ of our ESG strategy㠀 Management Implementation: Our ESG Working Group, which has Implementation representation from at least eight corporate functions,†⠀ is responsible for overall program implementation. 2024 ESG REPORT 10

Board oversight of ES儀 Our ESG program is overseen at the Board level through delegations of authority to two Board committees: The Nominating and Governance Committee oversees, and periodically reviews, the activities, The Compensation Committee oversees, and programs, risks, and public disclosures relating periodically reviews, certain strategies and to our ESG program, except for certain policies related to human capital management. strategies and policies related to human capital The Compensation Committee charter may be management. The Nominating and Governance accessed here. Committee charter may be accessed here. Our Board has adopted Corporate Governance Guidelines that address items such as the qualifications and responsibilities of our directors and director candidates and corporate governance policies and standards applicable to us, in general. In addition, our Board has adopted a Code of Ethics and Business Conduct that applies to all of our employees, o昀昀icers, and directors, including our CEO, Chief Financial O昀昀icer, and other executive and senior financial o昀昀icers. Board diversit茀 The Board is committed to ensuring it has a relevant diversity of skills and experience to oversee the Company, its management, its strategic plan, and the execution of that plan. Among the qualifications considered in the selection of director candidates, our Nominating and Governance Committee (the “Committee”) considers: experience, skills, expertise, diversity, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, and conflicts of interest, among other factors. As part of the search process for new directors, the Committee actively seeks to identify candidates who reflect diverse backgrounds, including diversity of race, ethnicity, and gender. Specifically, in any formal search for Board candidates where an initial candidate pool is assembled, the Committee will include, and will request that any search firm that it engages for such a search includes, qualified candidates with a diversity of race, ethnicity, and gender in that initial candidate pool. Femal攀 Mal攀 African Hispani挀 22.2% 77.8% America渀 or Latin砀 or Blac欀 11.1% 11.1% Asia渀 Whit攀 11.1% 66.7% 2024 ESG REPORT 11

Management diversit茀 Diversity at the highest levels of our organization is a strength. The following graphics depict gender and racial/ethnic diversity at the Vice President level and above: VP+ U.S. only Ethnicit礀 Gende爀 White Male 57.1% 47.5% 56.4% 50.0% Asian Female 28.6% 52.5% 28.2% 50.0% Black/African American Non-binary, Transgender,†⠀ Genderfluid, Genderqueer 8.6% 0.0% 7.7% 0.0% Latiné/Latinx/Latina/o/Hispanic 5.7% 2023 2024 5.1% Multiracial/Multiethnic 0.0% 2.6% 2023 2024 2024 ESG REPORT 12

Stakeholder engagemen縀 Maintaining open and honest dialogue with various stakeholder groups is an essential component to our business and furthers our mission to deliver honest financial products that improve lives. We engage with a diverse group of stakeholders, including our employees, consumers, merchant partners, investors, regulators, and communities. We value stakeholder feedback and use it to both inform our business strategy and to better understand stakeholder needs, priorities and expectations.⨀ We also recognize stakeholders’ interest in timely information concerning our ESG program and activities and plan to continue to provide information through regular updates to our ESG Report.⨀ A昀昀irm regularly interacts with stakeholders using a variety of mechanisms, including in-person and virtual meetings, social media, outreach, and community events. The following highlights some of the ways in which A昀昀irm engages each key stakeholder group: Merchant Partner Regulator Customer feedback sharin Regulatory reportin Self-service porta Responding to regulatory inquirie Retailer suppor Ongoing dialogue with A昀昀irm’s Government Ad hoc meetings via phone,†⠀ Relations tea email and in-person Meeting with state regulator Attending policy events Employee Communitie Daily online forums†⠀ A昀昀irm Cares Foundatio (Slack channels, intranet Employee volunteer program Regular company-wide meetings†⠀ Dialogue with consumer groups to promote with leadershi greater access to responsible credit Performance and development review Employee engagement survey Employee Resource and†⠀ Community Groups Consumer Investor Customer satisfaction survey Customer suppor Investor meetings and conference Dispute managemen Quarterly earnings call Social medi Other engagement (see “Stockholder Self-service portal and A昀昀irm app Engagement” below) Our public policy stakeholder engagement activities are overseen by our Government Relations and Public Policy team. We engage policymakers, regulators and legislators on matters of interest to A昀昀irm and comply with all applicable state and federal laws and regulations when we do so. 2024 ESG REPORT 13

Stockholder engagemen縀 We seek regular engagement with investors to communicate our strategy and solicit feedback from the investment community. Management periodically engages a third-party consultant to obtain independent feedback from our investors.ꨀ In FY’24, management participated in a number of investor conferences and meetings, both virtual and in-person. These meetings were attended by various members of A昀昀irm’s senior management, including our Chief Executive O昀昀icer, Chief Financial O昀昀icer, and/or Senior Vice Presidents. Management periodically discusses feedback, including key themes and other insights gained from the investor outreach meetings, at A昀昀irm’s Board and committee meetings, as appropriate㠀 In addition to our traditional investor relations outreach program, in early FY’24, our Lead Independent Director and the Chair of our Compensation Committee, along with members of our senior management, conducted A昀昀irm’s first virtual governance roadshow that included presentations and discussions regarding governance, compensation and other matters with certain of our investors. Some of the engagement highlights from the roadshow are as follows: We met with investors, who we believe held in the aggregate approximately 34.3% of our outstanding common stock with approximately 25.7% of the voting power of our outstanding common stock as of August 2023 We o昀昀ered meetings to additional investors, who we believe held in the aggregate approximately 18.6% of our outstanding common stock with approximately 4.9% of the voting power of our outstanding common stock as of August 2023. Excluding the holdings by our directors and executive o昀昀icers, we met with investors representing approximately 38.4% of our outstanding common stock with approximately 40.7% of the voting power of our outstanding common stock as of August 2023 Excluding the holdings by our directors and executive o昀昀icers, we conducted outreach to investors who we believe represented approximately 59.2% of our outstanding common stock with approximately 48.4% of the voting power of our outstanding common stock as of August 2023. The governance roadshow provided us with an opportunity to discuss a wide range of topics with our investors, including our directors’ skills and tenure, our Board’s oversight roles and responsibilities, our ESG program, and our approach to executive compensation matters.ꨀ Our Board, as well as our management team, values the perspectives of our investors as it helps us to understand and evaluate the e昀昀ectiveness of our current practices and related disclosures. 2024 ESG REPORT 14

Information securit茀 We use a variety of methods to keep our network secure and data safe. We also apply best practices that align with security industry standards for protecting personal information. Our policies safeguard the collection, use, and disclosure of that information. Data securit茀 As a global provider of payments and financial services technology solutions, one of our top priorities is protecting the security and confidentiality of consumers’ personal data and financial information. A昀昀irm maintains a data security program designed to be e昀昀ective at protecting sensitive data and resilient in responding to the cybersecurity threats㠀 Key components of A昀昀irm’s data security program include: Data Protectio砀 Physical Security and Resilienc茀 A昀昀irm uses industry-standard encryption A昀昀irm hosts its systems in state-of-the-art data both in transit on the internet and at rest centers that maintain strict controls around access, on our systems. redundancy, and environmental hazard protections. Threat Monitorin焀 A昀昀irm uses processes, tools and technologies to ensure the safety and integrity of A昀昀irm’s data and systems. Security monitoring includes detecting and responding to network intrusions as well as suspicious activity on our systems, such as unusual login attempts. Independent Assuranc漀 Application Securit茀 A昀昀irm engages trusted firms to conduct in-depth A昀昀irm designs its websites and applications with a focus third-party audits of our data security throughout the on consumer data security. Our developers continuously year against security control frameworks, including work to improve our code and review it regularly for flaws, NIST CSF, PCI DSS, and AICPA Trust Service Criteria; and we use web application firewalls to stop potential we are a PCI DSS Level 1 Service Provider for attacks online㠀 processing cardholder data, and we maintain SOC 1 and 2 Type 2 reports. 2024 ESG REPORT 15

Data privac茀 The privacy of our customers and their data is a top priority for A昀昀irm. We are committed to keeping our consumers' data confidential and secure so they can feel confident transacting with us. A昀昀irm maintains physical, electronic and procedural security measures to guard against unauthorized access to systems and uses various safeguards, including firewalls and data encryption. We enforce physical access controls to our buildings and we authorize access to personal information only for those employees or agents who require it to fulfill their job responsibilities. And, moreover, A昀昀irm never sells customer personal information. Through our Privacy Policy, we inform our consumers and employees about how and why we collect personal information. Cybersecurit茀 Our business and industry face an increasingly complex online threat environment. A昀昀irm invests in leading cybersecurity and fraud-prevention technology designed to prevent, identify, and mitigate fraudulent activity. 2024 ESG REPORT 16

Cybersecurity Risk Management and Strateg茀 We have established a cybersecurity program, informed by the National Institute of Standards and Technology Cybersecurity Framework (NIST CSF), that is designed to safeguard our information systems against cybersecurity threats. This program incorporates a variety of processes and cybersecurity tools designed to assess, identify and manage material risks from cybersecurity threats㠀 Those processes include automated and manual testing of our systems for vulnerabilities as well as monitoring and responding to suspicious activity. We use established cybersecurity risk frameworks to identify, measure and prioritize cybersecurity risks and develop corresponding cybersecurity controls and safeguards, and we have implemented a cybersecurity incident response plan that includes procedures for responding to cybersecurity incidents. Leveraging both internal and external resources, we conduct regular reviews and tests, including penetration testing as well as tabletop and red team exercises, to evaluate the e昀昀ectiveness of our cybersecurity program, enhance our cybersecurity measures, and inform our planning. We periodically engage external auditors and consultants to assess our cybersecurity programs. We also maintain a risk-based approach to identifying and overseeing risks from cybersecurity threats associated with our use of third party service providers. 2024 ESG REPORT 17

In addition, we require A昀昀irm employees to participate in cybersecurity awareness training.†⠀ These training sessions are designed to enhance our employees’ awareness of cybersecurity threats and provide information about best practices to protect A昀昀irm’s information systems. We require additional tailored cybersecurity training for certain employees based on their specific job responsibilities.⨀ Our cybersecurity program is integrated with our overall risk management program through our Chief Information Security O昀昀icer's (“CISO”) participation in governance structures such as the Risk Management Committee and Technology and Operational Risk Committee, and the incorporation of cybersecurity into A昀昀irm’s overall compliance and enterprise risk management programs. A昀昀irm also maintains cyber insurance coverage that may cover certain aspects of cybersecurity incidents, subject to the terms and conditions of the policy㠀 To our knowledge, as of August 29, 2024 (the date of publication of this ESG Report), A昀昀irm had not experienced a data breach involving its information systems that we determined to be material under the SEC’s cybersecurity incident reporting requirements. 2024 ESG REPORT 18

Cybersecurity Governanc漀 Our Board has delegated authority to its Audit Committee to oversee risks associated with cybersecurity threats. Members of the Audit Committee receive updates periodically from our CISO regarding cybersecurity risks. These updates include, among other topics, reviews of existing and newly identified cybersecurity risks, status updates on how management is addressing and/or mitigating those risks, information about cybersecurity incidents (if any), as well as updates regarding the status of key cybersecurity initiatives. Our CISO is principally responsible for assessing and managing our cybersecurity risk management program, in partnership with leaders from our Technology, Information Security, Internal Audit, Legal and Compliance teams. Such individuals have an average of over 20 years of prior work experience in various roles involving technology, information security, auditing and compliance. These individuals, including the CISO, are informed about and monitor the prevention, mitigation, detection and remediation of cybersecurity incidents through their management of, and participation in, the cybersecurity risk management and strategy processes described above, including the operation of our incident response plan. As discussed above, our CISO then makes periodic reports to the Audit Committee regarding such matters. 2024 ESG REPORT 19

Social responsibility: People come 昀椀rst Financial inclusion and socioeconomic empowermen縀 A昀昀irm’s mission is to deliver honest financial products that improve lives. Built into this mission are the concepts of financial inclusion and socioeconomic empowerment, which mean providing access to credit to those in need of it in an honest, transparent, and responsible manner.ꨀ Historically, low and moderate income (“LMI”) borrowers and individuals with low (or no) credit scores have only had access to credit products with high interest rates, fees, and other hidden costs. This is due, at least in part, to closures of traditional financial institutions in rural and urban areas, lack of access to a昀昀ordable financing options and predatory lending businesses filling the credit void. Unfortunately, these individuals are the ones who may need access to credit the most. With many current estimates indicating that more than half of Americans are living paycheck to paycheck (with that figure increasing dramatically in urban and rural areas), a significant portion of the American population—including LMI borrowers—are left to rely on some form of credit (credit cards, payday loans, pawn shops, etc.) to manage their personal cash flow. That leaves many with a di昀昀icult choice: being unable to make necessary purchases or having to do so with credit products that may resolve short-term financial needs but that may actually have an adverse financial impact in the long term.ꨀ A昀昀irm provides these individuals with another option. By looking at consumers as more than just their credit score, our underwriting is able to responsibly expand access to credit to more people, including those whose traditional credit scores may not represent their creditworthiness. In fact, in FY'24, the average FICO score of an A昀昀irm consumer was 652 with an average household income of $74,000. This provides critical access to honest and transparent financing to consumers, without ever being subject to hidden or late fees. Most importantly, A昀昀irm does not facilitate loans that we don’t believe can be repaid because we do not profit from consumers’ mistakes. 2024 ESG REPORT 20

FY’24 FICO Score by Consume簀 A昀昀irm lends to consumers at all levels of the credit spectrum and underwrites every transaction individually. Approximately 52% of A昀昀irm consumers had FICO scores below 660, and the average FICO score per consumer was 652 during FY’24. Developing Credi琀 2% Deep Subprim攀 10% Superprim攀 18% Subprim攀 17% Prim攀 30% ⨀ Based on data between July 2023 - June 202㐀 Near Prim攀 * Superprime: 730+, Prime: 729 - 660, Near Prime:†⠀ 23% 659 - 620, Subprime: 619 - 580, Deep Subprime:†⠀ 579 - 0, Developing Credit: No available credit score. FY’24 Annual Income by Consume簀 A昀昀irm’s consumers span all income levels. In FY’24, approximately 52% of A昀昀irm consumers earned less than $60K per year and average household income per consumer was $74,000. Below $20,00 4% Above $100,00 19% $20,000 - $40,00 23% $40,000 - $60,00 25% $60,000 - $100,00 29% * Based on data between July 2023 - June 2024 2024 ESG REPORT 21

Moreover, A昀케rm’s consumers are both†⠀ demographically and geographically divers漀 In FY’24, our largest cohorts of consumers were Millennials, followed by Gen X, Gen Z, and Baby Boomers. Gen 娀 Baby Boomer猀 15% 10% Gen 堀 29% Millennial猀 46% ⨀ Based on data between July 2023 - June 202㐀 㐀 Gen Z: 1997 - 2012, Millennials: 1981 - 1996,†⠀ Gen X (1965 - 1980), Baby Boomers+ (before 1964⤀ * Based on share of unique users A昀昀irm’s consumer base is reflective of the U.S. population, with users from the top five most populated states in the nation comprising over 40% of A昀昀irm’s active users in FY’24. Notably, A昀昀irm has consumers in every U.S. state. 2,435,836 * Based on data betwee渠⠀ July 2023 - June 202㐀 * Based on unique users 664 We believe we can improve lives through responsible lending. A昀昀irm’s products are widely available—anyone with access to the Internet, regardless of their personal economic circumstances, may apply for an A昀昀irm loan to complete a purchase. Moreover, A昀昀irm empowers consumers by o昀昀ering a transparent and flexible way to pay over time with no late or hidden fees and the ability to pay at their own pace in incremental payments with simple (as opposed to compounding) interest. A昀昀irm’s success is fundamentally aligned with consumers: we win when they win. 2024 ESG REPORT 22

Customer Experienc漀 A昀昀irm’s Customer Advocacy team is responsible for managing complaints, facilitating social media engagement, overseeing and analyzing servicing sentiment surveys (which assess customer satisfaction, customer e昀昀ort score and other key servicing metrics), as well as coordinating and executing any customer-facing remediation e昀昀orts to ensure the most fair outcomes for customers. The Customer Advocacy team works adjacent to the broader servicing network to support engagement with our customers over phone, email and live chat to ensure a close connection to the trends that are driving customer contacts on the front lines of servicing. Customer feedback is evaluated on a daily basis across the Service Delivery and Customer Advocacy teams. The Customer Satisfaction Survey (“CSAT”) is a best practice tool used primarily to gauge how customers feel about the service they received from the customer support agent. A昀昀irm has designed its CSAT survey to additionally capture Customer E昀昀ort Score (“CES”), which assesses overall di昀昀iculty in issue resolution, and Customer Perceived Resolution (“CPR”), which assesses customer satisfaction with the resolution. This survey is sent to anyone who contacts A昀昀irm and receives service from an agent. Through this comprehensive CSAT survey, A昀昀irm generates daily feedback from customers that informs its business on customer sentiment towards A昀昀irm as a product and service, overall, as well as their experience interacting with the servicing team.⨀ A昀昀irm uses the CSAT survey results to inform business decisions that advocate for a better customer experience. Cross-functional teams assess trends highlighted in monthly reports and weekly business reviews to ensure action is being taken to improve the customer experience. Some examples of improvements made as a result of the insights provided in these forums include, but are not limited to, the following: Streamlinin朠⠀ Redesigning the†⠀ Uniting the A昀昀irm and customers’ contact dispute managemen琠⠀ A昀昀irm Card (formerly experience and flow for customer Debit+) apps improving self-service†⠀ disputes to improve capabilities resolution timeframe 2024 ESG REPORT 23

Financial literacy and community impac縀 While we view financial inclusion as a critical component of our positive social impact, it is incomplete without the promotion of financial literacy. This is why A昀昀irm’s core value of “No fine print” is so important to our business—our consumers understand the exact payment terms before they complete the transaction. There are no “gotchas.” There are no surprises.ꨀ All A昀昀irm consumers to whom credit is extended receive Truth in Lending disclosures for all our products. This ensures that consumers receive consistent and transparent disclosures. A昀케rm Care紀 We also seek to positively impact our communities through the A昀昀irm Cares Employee Foundation (“A昀昀irm Cares”). A昀昀irm Cares is an A昀昀irm employee volunteer-led 501(c)3 non-profit established by A昀昀irm in 2019. A昀昀irm Cares aims to make a positive impact in the communities in which we work and live by sharing our expertise and funding across three impact pillars: financial literacy and inclusion, technology education and training, and vibrant communities. Since its inception in 2019, the A昀昀irm Cares Employee Foundation has raised and awarded grants of over $920K to local community non-profits. The A昀昀irm Cares Annual Reports are available here. Financial literac礀 Technology educatio渀 Vibran琠⠀ & inclusio砀 & trainin焀 communitie紀 Provide fair and responsible Support access to technology Partner with organizations focused credit for communities and for K–12 coding academies and on housing insecurity, homelessness, businesses, credit education bootcamps, as well as provide civic engagement, neighborhood support, and nonprofit workforce development and preservation and revitalization,†⠀ investments focused on support for small urban and small business development,†⠀ equitable economic growth. rural businesses. and community enrichment. 2024 ESG REPORT 24

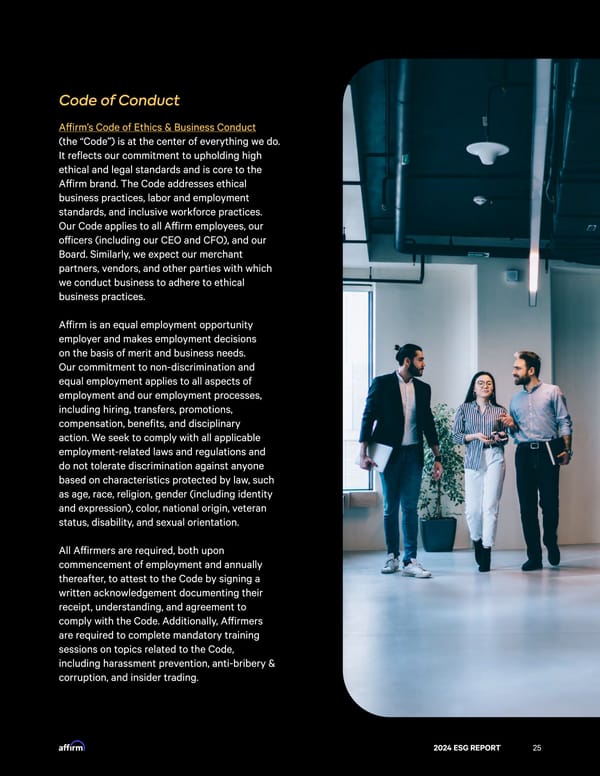

Code of Conduc縀 A昀昀irm’s Code of Ethics & Business Conduct†⠀ (the “Code”) is at the center of everything we do. It reflects our commitment to upholding high ethical and legal standards and is core to the A昀昀irm brand. The Code addresses ethical business practices, labor and employment standards, and inclusive workforce practices. Our Code applies to all A昀昀irm employees, our o昀昀icers (including our CEO and CFO), and our Board. Similarly, we expect our merchant partners, vendors, and other parties with which we conduct business to adhere to ethical business practices.ꨀ A昀昀irm is an equal employment opportunity employer and makes employment decisions†⠀ on the basis of merit and business needs.†⠀ Our commitment to non-discrimination and equal employment applies to all aspects of employment and our employment processes, including hiring, transfers, promotions, compensation, benefits, and disciplinary†⠀ action. We seek to comply with all applicable employment-related laws and regulations and†⠀ do not tolerate discrimination against anyone based on characteristics protected by law, such as age, race, religion, gender (including identity and expression), color, national origin, veteran status, disability, and sexual orientation㠀 All A昀昀irmers are required, both upon commencement of employment and annually thereafter, to attest to the Code by signing a written acknowledgement documenting their receipt, understanding, and agreement to comply with the Code. Additionally, A昀昀irmers†⠀ are required to complete mandatory training sessions on topics related to the Code,†⠀ including harassment prevention, anti-bribery & corruption, and insider trading. 2024 ESG REPORT 25

Human right紀 At A昀昀irm, we recognize our responsibility to respect and protect human rights by providing fair working conditions and prohibit the use of any forced, compulsory, or child labor by or for A昀昀irm. A昀昀irm’s Human Rights Policy embodies our commitment to human rights and outlines expectations related to ethical business practices, community engagement, protection of rights and economic inclusion, diversity and inclusion, and workplace conditions. Similarly, we expect our merchants to respect and protect human rights by providing fair working conditions and to prohibit the use of any forced, compulsory, or child labor.ꨀ We are dedicated to creating a workplace that respects and values all employees and maintains an environment of open and direct communication. We believe that women's rights, minority rights, and economic inclusion are priorities for long-term success. Unconscious bias training is conducted to raise awareness and drive conversations to create more e昀昀ective leaders, more productive teams, and a more inclusive organizational culture. A昀昀irm strives to adequately compensate its employees and pays employees at least minimum wage, where applicable laws apply. ꨀ Health and safet茀 A昀昀irm puts employee health and safety at the forefront of our operations. We are committed to the health and safety of our employees and will exercise reasonable care in providing each employee a workplace free of recognized hazards, including violent acts or threats of violent acts against employees or third parties within our workplaces. A昀昀irm does not tolerate violence or threats of violence and takes reasonable measures to provide a safe workplace that complies with applicable safety and health laws and regulations. 2024 ESG REPORT 26

Health and Safety Management Syste眀 A昀昀irm has implemented an integrated occupational health and safety management system based upon, and guided by, federally and internationally recognized standards and principles, including ISO 45001 and ISO 14001. The system is designed to e昀昀ectively manage and address health and safety risks within our operations and encompasses, at a minimum, the below standards: Policy and commitmen縀 Emergency preparedness and respons漀 Our Global Health and Safety Policies establish We have developed site-specific plans and our commitment to employee safety and the procedures to e昀昀ectively respond to emergencies framework for implementing a safe and healthy within our workplaces. We maintain an emergency work environment at A昀昀irm. The policies also communication system to promptly inform impacted establish the structure and responsibilities of employees of emergencies and emerging threats that health and safety at A昀昀irm. may have the potential to adversely a昀昀ect them. Incident reporting and investigatio砀 Risk assessment and hazard identificatio砀 Processes are established to encourage the We identify potential risks and hazards†⠀ reporting of incidents, near misses, and hazards. associated with our operations and evaluat攠⠀ Incidents are thoroughly investigated to identify their impact. Using these assessments,†⠀ root causes and implement corrective actions to we prioritize preventative measures and†⠀ prevent similar occurrences in the future. implement controls to minimize risks. Training and competenc漀 Data compilation and audi縀 Employees receive appropriate health and safety A昀昀irm partners with a global leader in health and safety training and/or resources to ensure they compliance reporting and self-auditing. All health and understand the risks associated with their work safety compliance requirements impacting our organization and know how to perform their tasks safely. are identified and compiled within this system. Continuous improvement, feedback, and employee engagemen縀 We foster a culture of continuous improvement, where feedback from employees, stakeholders, and external sources is actively sought and used to enhance health and safety practices. Lessons learned from incidents and near misses are incorporated into future risk management strategies. We encourage our workforce to engage in our Safety Committees to provide feedback, identify hazards, and get involved with a safety-centric culture. OSHA recordable accident rat漀 A昀昀irm tracks work-related accidents, injuries, and near-misses in our workspaces. We have not had any instances of work-related accidents (for either A昀昀irmers or individuals in a contractor capacity with A昀昀irm) recordable under Occupational Safety and Health Administration (“OSHA”) standards for at least three recent consecutive years. 2024 ESG REPORT 27

Diversity, Equity, and Inclusion at A昀케r眀 We believe that diversity, equity, and inclusion (“DEI”) are important as we scale and build our†⠀ high-performing team. Our strategy involves embedding DEI into our processes, programs, and structures at A昀昀irm across the employee lifecycle — how we hire, develop, advance, and retain A昀昀irmers, and in how we do business㠀 Our Diversity and Inclusion Steering Committee (“DISC”), an internal committee made up of senior leaders from across A昀昀irm, provides oversight, support, and guidance to departments and teams on initiatives that may impact the ability to support diverse populations of key constituencies: employees, consumers and merchants. DISC is also responsible for reviewing that internal and external initiatives reflect our high bar for DEI, and the members help to amplify high-impact DEI e昀昀orts happening within their own departments. Below are several achievements from our DEI work in FY’24: In FY’24, we launched A昀昀irm’s DEI Learning Program. This program consists of self-paced courses for all A昀昀irmers on topics like inclusive leadership & culture, practicing allyship, microaggressions, and neurodiversity in the workplace, along with a variety of other topics in support of cultivating psychological safety and a high-performance culture. In collaboration with learning opportunities from our Learning & Development team, 52% of employees completed at least one self-paced course during the fiscal year. We plan to continue to highlight both long-format and micro-learnings on DEI topics in continued collaboration with the Learning & Development team, make focused e昀昀orts to increase participation, and measure success of learning outcomes. A昀昀irm also seeks to establish We have thoughtfully and intentionally†⠀ our commitment to DEI within redesigned our framework for A昀昀irm’s†⠀ our merchant network, collect Community program to increase impact,†⠀ data on A昀昀irm merchants align with the greater DEI strategy, and foster†⠀ owned by diverse communities, a stronger sense of community for all A昀昀irmers. and share promotional The implementation of this redesign will roll†⠀ opportunities with merchants out over several quarters and involve many that opt in. In FY’24, through program-specific initiatives, including: various A昀昀irm-sponsored merchant diversity Tracking and sharing impactful†⠀ campaigns and promotions, data that tells the story of the A昀昀irm we achieved a 61% year-over- Communities@ program year increase in merchant partners that are certified Executive Sponsorship engagement†⠀ women-, veteran-, or to ensure role alignment and expectations. minority-owned businesses. 2024 ESG REPORT 28

We annually publish our DEI Report, which discloses certain demographic information relating to our team and outlines our DEI goals, our progress toward them, our areas for here improvement, and where we expect to focus our e昀昀orts. The 2024 report is available , but below are some highlights from the report that we are proud to share. Gender Male 57.4% 56.1% Female 41.5% 42.9% Non-binary, Transgender,†⠀ Genderfluid, Genderqueer 1.1% 1.0% Male Female Non-binary, Transgender,†⠀ 2023 2024 Genderfluid, Genderqueer Ethnicit礀 U.S. only White 46.0% 47.8% Asian 33.6% 31.6% Black/African American 6.9% 7.2% Latiné/Latinx/Latina/o/Hispanic 5.8% 5.7% Multiracial/Multiethnic 5.7% 6.1% Southwest Asia/North Africa 1.4% 1.1% Native Hawaiian or Other Pacific Islander 0.6% 0.5% American Indian/Alaskan Native 0.1% White Multiracial/Multiethnic 0.1% Asian Southwest Asia/North Africa Black/African American Native Hawaiian or Other Pacific Islander Latiné/Latinx/Latina/o/Hispanic American Indian/Alaskan Native 2023 2024 To see this data using U.S. government reporting categories, view our EEO-1 report here. 2024 ESG REPORT 29

Compensatio砀 We have created a simple, flexible, and†⠀ transparent remote-first compensation structure that reinforces A昀昀irm’s core values and links compensation to performance. In November 2023, we published geographic di昀昀erentials, pay grades, and pay structures for every job at the company. We believe this level of transparency inspires confidence in how compensation decisions are made and builds trust amongst our team㠀 The following are the key components of A昀昀irm’s compensation program: Transparent compensation structur漀 Remote-first compan茀 Access to published cash and equity pay grades Support a competitive remote-first for all roles at the company to promote compensation approach with the ability to live transparency in compensation. and work from any supported country. Frequent compensation review紀 Pay equit茀 Ability for managers to submit cash compensation Periodically review pay equity results using recommendations anytime during the year with statistical software to identify and remediate periodic cycles equity adjustments. statistically significant di昀昀erences in pay. Built In 2024 Best Places to Wor甀 A昀昀irm ranked in the top 100 best places to work in 2024 in the remote companies category. 2024 ESG REPORT 30

Bene昀椀t紀 Anchoring to our core value of People Come First allows us to take a human-centric approach to benefit design and decision making. When people come first, we empower employees to perform at their best by supporting all aspects of their health and wellbeing throughout life’s moments㠀 In practice, this means that we o昀昀er a wide range of benefit programs to meet the†⠀ diverse needs of A昀昀irmers. Health Access to market-leading medical plan coverage,†⠀ with $0 contributions for employees and their dependents. 100% coverage for in- and Partnership with a leading out-of-network mental health mental well-being vendor to services to ensure there are provide 12 free therapy/ no financial barriers to coaching sessions to employees receiving necessary care. and their dependents, annually. Financial Access to a financial well-being platform with tools and resources†⠀ for financial planning, and unlimited 1:1 access to a certified financial planner. Wellbeing Spending wallets provide $650 per month Free access to a family planning vendor for A昀昀irmers to use on a wide range of that provides support and resources expenses. We also provide a $20,000 related to family building needs, e.g., lifetime allowance for surrogacy, adoption, or fertility, pregnancy and postpartum, egg freezing expenses. adoption, surrogacy, among others. Time away A Flexible Time O昀昀 program ensures We o昀昀er 20 Away Days in the US, A昀昀irmers have the ability to take time o昀昀 inclusive of federally observed holidays and recharge when they need it. and wellness days. 18-week paid parental leave†⠀ We provide 10 Health Days per year for is available to birth parents and†⠀ illness/preventive care, and 15 days for non-birth parents, in addition to a†⠀ Life Happens Leave, which can be used 4-week “ramp back” period where for situations related to COVID, caregiving employees receive 100% of their regular responsibilities, travel for purposes of salary for working half of their normal hours receiving out-of-state medical care, (to allow an easier transition back to work). among other reasons. We o昀昀er full-time and part-time (regularly scheduled for at least 24 hours per week) employees 1 day (eight hours) of paid volunteer time at the start of every calendar year. A full list of the benefits that A昀昀irm o昀昀ers employees is available here. 2024 ESG REPORT 31

Training and developmen縀 At A昀昀irm, we take pride in investing in our employees’ success and growth. This includes providing A昀昀irmers with meaningful learning resources, development programs and career opportunities to support them at every stage of their journey. This enables a high-performance culture where A昀昀irmers can drive impact for the organization and thrive in their career㠀 Our commitment to our employees begins with our A昀昀irm Foundation program, which is a 100-day onboarding program designed to help new hires build foundational skills, connections, and knowledge to succeed in their roles.⨀ Beyond the A昀昀irm Foundation program, A昀昀irmers are supported in a number of ways, including through blended learning and career experiences. By way of example, A昀昀irm o昀昀ers the following training and professional development programs for employees: LearnNo脀 Leadership development programmin焀 A one-stop shop for all learning content A series of curricula for people leaders to developⰠ⠀ at A昀昀irm, including 6000+ eLearning refine and practice foundational leadership skills㨠⠀ courses o昀昀ered by Udemy. feedback, psychological safety, 1:1s, etc. BetterUp coachin焀 Senior Leader Summi縀 O昀昀ered to director-level employees and above, BetterUp Annual summit that brings together A昀昀irm’s most senior is a coaching platform that connects participants with leaders to deepen cross-functional relationships, develop ICF-certified coaches. Used as both a self-guided leadership capabilities, and remove barriers to high leadership development tool and a support resource. performance across the organization. How are employees investing In FY’24, the average annual hours of training per employee their time to learn? was 18.05 hours (or a total of 28,414 learning hours across†⠀ all A昀昀irmers). Employees completed training on various business topics such as leadership, management skills, facilitation, instructional design, business analysis, and project management. In addition, employees also completed tech training topics on Python, JavaScript, Web Development, AWS Solutions, and Kubernetes㠀 A昀昀irm evaluates the e昀昀ectiveness of our learning programs through a number of approaches, including skills assessment tools, management insights (including quarterly employee engagement surveys and learning feedback surveys), and needs assessments to ensure that our learning content 23% Business skills enables A昀昀irmers at all levels to be successful and grow†⠀ 72% Technology skills 5% Personal development their capabilities in support of A昀昀irm’s goals and mission. 2024 ESG REPORT 32

Performance managemen縀 A昀昀irm conducts regular performance evaluations to foster the growth and development of our employees. A昀昀irm’s performance and feedback program includes the following elements: Upward feedbac甀 Ad hoc feedbac甀 Completed by employees to provide feedback Encouraged throughout the year to supplement about their experience with their managers via a formal review discussions⸀ multiple choice survey. Peer feedbac甀 Self review紀 Feedback from employees’ peers or partners Completed by all A昀昀irmers to reflect on their throughout the year, either requested by performance areas of strength and opportunity managers or shared directly peer-to-peer, to during the assessment period, as well as desired provide additional perspective for employees on skills on which they plan to focus in future periods⸀ their performance and development. Manager review紀 Completed by managers to indicate whether an employee is meeting the expectations of their role and level, as well as a brief description of the employee’s performance areas of strength and opportunity observed during the assessment period. 2024 ESG REPORT 33

Employee Satisfaction and Engagemen縀 A昀昀irm monitors employee satisfaction and engagement through quarterly surveys The TAP Surve茀 The TAP Survey is a pulse check on employee sentiment. In addition to engagement, it focuses on key themes, such as learning, leadership, wellbeing, DEI, and compensation & benefits. In FQ4’24, 81% of A昀昀irmers completed the TAP Survey with an overall engagement score of 7.8 (out of 10). As a direct result of feedback from the DEI portion of the TAP survey, psychological safety will be a top focus area for the DEI team in FY’25 The High Performance Culture Surve茀 The High Performance Culture (“HPC”) Survey measures how e昀昀ectively A昀昀irm is removing barriers to productivity and cultivating a high performance culture over time. Our proprietary HPC survey is directly tied to our FY’24 Company Objectives and Key Results (“OKRs”). In FQ4’24, 81% of A昀昀irmers completed the HPC Survey with an overall score of 8.0 (out of 10). As a direct response to A昀昀irmer feedback, the People Analytics team launched the Meeting Optimization Initiative aimed at improving our meeting culture. Removing barriers, such as unnecessary meetings, is aimed at accelerating productivity across A昀昀irm to help cultivate a high performance culture. According to the 2021 Great Place To Work Global Employee Engagement Study, 85% of employees at A昀昀irm say it is a great place to work compared to 57% of employees at a typical U.S.-based company. A昀昀irm is proud to be a Great Place to Work Certified company in the United States 2024 ESG REPORT 34

Environmental impac琀 & sustainability㨀 Push the envelope We actively manage our environmental impact across our facilities through practices and partnerships focused on addressing climate change, sustainably managing resources, and mitigating our environmental impact. We believe that energy and resource data collection and disclosure will showcase a quantifiable view of A昀昀irm’s environmental impact and provide insights on where we can focus our ongoing e昀昀orts to be a more sustainable company. To demonstrate our commitment to minimizing our environmental impact, we adopted an Environmental Policy in January 2024. Energy e昀케cienc茀 A昀昀irm is a remote-first company, which results in relatively lower energy consumption at our o昀昀ice locations. We lease our o昀昀ice locations and generally operate in buildings with accredited green building certifications. As of the end of FY’24, 89% of our o昀昀ice footprint (based on square footage) was covered by either a Platinum or Gold Leadership in Energy and Environmental Design (“LEED”) certification, with only a single o昀昀ice location not meeting this criteria. Our San Francisco headquarters is located in Our Toronto o昀昀ice is located in an Our Chicago and New York o昀昀ices a sustainable o昀昀ice building that is Energy Energy Star Certified, LEED Platinum, are located in buildings that are Star, LEED Platinum, and WiredScore Gold- and Boma Best Gold building⸀ LEED Gold certified⸀ certified, reflecting its energy e昀昀iciency. Environmental Footprin縀 While A昀昀irm’s environmental footprint is relatively small, we recognize the need to address climate change and are committed to identifying ways to lower our emissions in our operations. As part of that commitment, we took an important step this year by refining our processes for calculating our Scope 1 and Scope 2 emissions - as well as calculating our Scope 3 emissions for the first time - to better assess our environmental impact and to be more comprehensive in our emissions reporting. More specifically, we calculated our Scope 1 and Scope 2 emissions based on actual consumption data rather than using estimations based on square footage for the substantial majority of our o昀昀ice locations, which was the methodology we used for the 2023 ESG Report. We intend to use this data to inform future strategies to make meaningful reductions. 2024 ESG REPORT 35

Our operational GHG emissions footprin縀 The largest drivers of our operational GHG emissions are the energy we use in our o昀昀ices (electricity, heating and cooling), our cloud computing, business travel, home working, and use of sold products. Our key categories of emissions include: Scope ‼㱏 A昀昀irm’s Scope 1 emissions are the direct emissions from operations that are owned or controlled by A昀昀irm. Because A昀昀irm leases all o昀昀ice locations, the energy consumed through the heating of our o昀昀ices is considered Scope 2 emissions. A昀昀irm does not maintain any of our own physical data centers. We host everything in the cloud, which helps improve energy e昀昀iciency. A昀昀irm’s cloud and marketing services are included in our Scope 3 emissions.ꨀ Scope 㰀᐀ A昀昀irm’s Scope 2 emissions are the indirect emissions from the generation of purchased electricity, heating, and steam consumed by A昀昀irm㠀 Scope 㴀 A昀昀irm’s Scope 3 emissions are the indirect emissions from our value chain, including both upstream and downstream emissions associated with the energy used to operate our cloud services (Category 1 - Purchased Goods and Services), commercial air travel (Category 6 - Business Travel), remote work (Category 7 - Home Working) and use of a昀昀irm’s products (Category 11 - Use of Sold Goods). Greenhouse Gas Emissions by Scope In metric tons of CO2 equivalent Greenhouse gas emissions 2023*** Scope 1 N/A Scope 2* 158 Scope 3** 5,766 Total greenhouse gas emissions 5,924 * As a result of refining our data collection process for the FY’24 ESG Report, we reclassified Scope 1 emissions as Scope 2 emissions. This is due to the fact that A昀昀irm does not own its o昀昀ices. A昀昀irm’s Scope 2 emissions are comprised of purchases of finished energy – primarily electricity, heating, and steam. ****** Scope 3 emissions are comprised of: Category 1 (Cloud Computing) - 528 metric tons of CO2; Category 6 (Business Travel) - 2,242 metric tons of CO2; Category 7 (Home Working) - 2,768 metric tons of CO2; and Category 11 (Use of Sold Products) - 228 metric tons of CO2. *** See A昀昀irm’s 2023 ESG Report for information on Scope 1 and Scope 2 emissions for the 2021 and 2022 calendar years. Note that the di昀昀erence between FY’23 emissions and previously reported emissions is due to the following factors: transitioning methodology from estimations to actual consumption; transitioning assessment periods from calendar to fiscal year; reclassification of Scope 1 emissions to Scope 2 emissions due to the nature of ownership of our o昀昀ice locations (leased vs. owned); and significant decreases in square footage leased at certain of our o昀昀ice locations that occurred during FY’23. A昀昀irm’s FY’23 GHG emissions totaled 5,924 metric tons of CO2. Substantially all of our emissions (97%⤠⠀ are classified as Scope 3 that, by definition, are from sources neither owned nor controlled by A昀昀irm.ꨀ Emissions for each activity have been calculated by applying measurements and relevant emissions factors to actual consumption data. The inventory is believed to encompass all relevant Scope 1, 2 and 3 emissions for which A昀昀irm is accountable, according to current practice of carbon reporting as defined by the Greenhouse Gas Protocol Standard (World Business Council for Sustainable Development and World Resources Institute, 2004). 2024 ESG REPORT 36

Waste managemen縀 E昀昀ective waste management is important to A昀昀irm’s overall sustainability e昀昀orts. We are committed to implementing strategies to reduce the amount of waste we produce and increase our conservation e昀昀orts. As part of these e昀昀orts, we have established recycling and composting practices at our o昀昀ice locations㠀 A昀昀irm’s waste management initiatives include: Recycling bins are utilized Compost bins ar攠⠀ Compostable utensils throughout our o昀昀ice locations available for foo搠⠀ and dishes are stocked to recycle paper products, waste at ou爠⠀ in our o昀昀ice kitchen plastics, and glass. o昀昀ice locations. locations. In the past, we partnered with TerraCycle® to recycle We partner with a third-party electroni挠⠀ co昀昀ee pod waste created in our o昀昀ices through a waste recycling company to dispose an搠⠀ process where used co昀昀ee grounds from the pods recycle decommissioned electronics and tech were composted and the metal and plastic equipment. In FY’24, we recycled 695 computers, components were recycled. As of the end of FY’24, tablets and phones, and over 1,800 pound猠⠀ our o昀昀ices do not create enough waste to warrant a of electronic waste was either recycle搠⠀ continued partnership with TerraCycle. or diverted from landfills. Partnership with LiquiDonat漀 The cornerstone of A昀昀irm’s ESG strategy is to sustainably advance our mission to improve lives. In 2023, we partnered with LiquiDonate, an organization known for keeping “gently loved” items out of landfills and moving them into the community. Together, we were able to divert 9,000 pounds of o昀昀ice items from landfills to local nonprofits, schools, and businesses in need. 2024 ESG REPORT 37

Water Managemen縀 A昀昀irm recognizes the importance of e昀昀ective Water Consumptio渀 (in thousands of gallons) water management and that access to clean water is a universal human right, as defined by 1000 the United Nations.1 Due to both the nature of 800 917.7 2 our business and our remote-first operational structure, A昀昀irm consumes relatively low 600 volumes of water in our leased o昀昀ice locations 400 and uses low-flow faucets and fixtures. We obtain water from the local water utilities that 200 serve our locations, and in FY’24, we began to 0 track our water usage at the o昀昀ice locations FY’23 where we receive a water utility bill. 1 The United Nations defines the right to water as universal access to su昀昀icient, safe, acceptable, physically accessible, and a昀昀ordable water. 2 Water consumption is presented only for o昀昀ice locations where A昀昀irm received a water utility bill during the 2023 fiscal year (Pittsburgh, Toronto and Chicago). For our Chicago o昀昀ice location, we calculated water consumption through a proration method that estimated our water usage based on our percentage square foot occupancy when compared to the building’s overall square footage. 2024 ESG REPORT 38

2024 Climate-related Risk and Opportunity Screening Introductio砀 In FY’24, A昀昀irm conducted a physical and transition risk and opportunity screening designed to identify and assess climate-related risks and opportunities that might impact its direct operations and consumers in North America. The analysis focused primarily on A昀昀irm’s five leased o昀昀ices in San Francisco, Chicago, Pittsburgh, New York City, and Toronto, as well as four states with a significant consumer presence (California, Texas, Florida, and New York). In summary, the results of this risk assessment indicate that A昀昀irm does not currently face any material physical or transition risks related to climate change. Vulnerability Assessment The first step in A昀昀irm’s climate-related risk and opportunity screening was to conduct a vulnerability assessment for both physical risk and transition risk. Physical risk refers to the potential impact of the physical consequences of climate change. The Physical Risk physical risk vulnerability screening examined the following climate hazards: increasing average temperatures, heatwaves, droughts, wildfires, winter weather, heavy precipitation and inland flooding, and sea level rise. The following assets were considered: o昀昀ices, employees, data processing centers, and consumers. The screening covered these steps determining asset exposure to each of the climate hazards based on historical†⠀ and future location-specific data, as well as available climate scenarios measuring sensitivity of assets to the relevant climate hazards; and identifying A昀昀irm’s existing adaptive capacity measures, such as mitigation e昀昀orts,†⠀ to climate hazards, as applicable㠀 The initial physical screening focused on assessing which climate hazards may lead to unavoidable business disruption. It was determined that employees, either working in an A昀昀irm o昀昀ice or remotely in the area of an A昀昀irm o昀昀ice, may be a昀昀ected by the e昀昀ects of wildfires, heatwaves, and heavy precipitation and flooding. In addition, winter weather was determined relevant for assessment in the Chicago o昀昀ice. A昀昀irm was determined to be vulnerable to these four climate hazards.ꨀ Furthermore, A昀昀irm evaluated physical risks of its consumers across the four in-scope states and concluded that the occurrence of any of these four climate hazards would likely have no significant impact on A昀昀irm revenue, since A昀昀irm’s consumers are spread out across varying climates within those states, and climate-related events (such as wildfires) historically have not had a meaningful impact on A昀昀irm revenue㠀 Having concluded that A昀昀irm was vulnerable to these four climate hazards, as discussed under “Risk Assessment” below, A昀昀irm then proceeded to conduct a risk assessment in order to estimate for each o昀昀ice the potential financial impact on revenue associated with these hazards. 2024 ESG REPORT 39

Transition risk refers to the risks associated with addressing or adapting to future market, Transition Risk technology, or other changes related to climate change. Transition opportunities are benefits that e昀昀orts to mitigate and adapt to climate change may produce. The transition risk vulnerability screening process included identifying risks and opportunities, determining the type of risk/opportunity, and evaluating the relevancy to A昀昀irm of such risks and opportunities. The vulnerability rating per risk and opportunity was determined by its relevancy and A昀昀irm’s adaptive capacity or ability to mitigate exposure to various regulatory, market, technology, and reputational changes. Eight risks and one opportunity were evaluated: Regulatory Technology Carbon pricing mechanism紀 Corporate emissions†⠀ Corporate Sustainability Reporting Directive and merchant retention (CSRD) and Corporate Sustainability Due Diligence Directive (CSDDD) Market Reputation Renewable energy procuremen縀 Investor perceptio砀 Market failure/economic downtur渠⠀ Employee retentio砀 caused by climate chang漀 Consumer relief and aid (opportunity) Changes in consumer behavior While corporate emissions and merchant retention and market failure/economic downturn caused by climate change were identified as highly relevant risks, no single merchant represented more than 10% of A昀昀irm’s total revenue as of June 30, 2024, and A昀昀irm has diverse originating bank partners. Therefore, the results of this vulnerability assessment indicate that A昀昀irm has a high adaptive capacity to mitigate these respective risks. However, the results also indicate that A昀昀irm is vulnerable to the following transition risks and opportunities carbon pricing mechanism CSRD and CSDD renewable energy procuremen investor perceptio employee retentio consumer relief and aid (opportunity) ꨀ Having concluded that A昀昀irm was vulnerable to these transition risks, as discussed under “Risk Assessment” below, A昀昀irm then proceeded to conduct a risk assessment to assess, either quantitatively or qualitatively as data allowed, the potential financial impact of these risks and opportunities. Risk Assessmen縀 Risks and opportunities to which A昀昀irm was determined to be vulnerable were assessed to estimate the potential financial impact. Where financial impact could not be estimated quantitatively, the impacts were assessed qualitatively.⨀ The following physical and transition risks were assessed quantitatively: Heavy precipitation & inland flooding Renewable energy procurement Wildfires Winter weather Carbon pricing Heatwaves 2024 ESG REPORT 40

The following transition risks were assessed qualitatively due to data limitations and uncertainty related to impact: CSRD†⠀ Investo爠⠀ Employe攀 Consumer relie昀 and CSDDD perception retention and aid (opportunity) Where possible, potential risks were quantified using climate impact factors and A昀昀irm-specific inputs. The results of this financial consequence assessment were evaluated using A昀昀irm’s existing Risk Assessment Methodology to ensure that climate-related risks are aligned to A昀昀irm’s overall enterprise risk management process. Financial consequence ratings and likelihood ratings were used to determine overall risk ratings per facility.⨀ Based on this scale, A昀昀irm concluded that it is only exposed to one High physical risk (heatwaves in San Francisco). This is due to both lower rates of air conditioning use in the San Francisco Bay Area and a high concentration of A昀昀irm employees.⨀ While not quantified, A昀昀irm concluded that exposure to CSRD and CSDDD presents a High transition risk to A昀昀irm as there will be additional burden to comply with reporting obligations in the event that its business expands into the European Union (the “EU”). 㬀 The following risks are categorized as Moderate or Low: Risk category Risk Moderate Heatwavesꀀ (New York City, Pittsburgh, Chicago, Toronto㌀ Heavy precipitation and inland floodingꀀ (New York City, Pittsburgh, Chicago㌀ Wildfiresꀀ (New York City, Pittsburgh, Chicago, San Francisco㌀ Investor perception Low Heavy precipitation and inland floodingꀀ (Toronto㌀ Wildfiresꀀ (Toronto㌀ Winter weatherꀀ (Chicago㌀ Carbon ta舀 Renewable energy procuremen縀 Employee retentio砀 Consumer relief and aid (opportunity) Overall, the identification and quantification of A昀昀irm’s physical and transition risks in direct operations sets the foundation for A昀昀irm to develop a comprehensive climate strategy. 1 As of the end of FY’24, A昀昀irm’s operations in Poland and Spain did not meet the employee or net turnover thresholds required under CSRD, and A昀昀irm securities were not listed on EU-regulated markets. If A昀昀irm's employee presence in the EU increases in future years, if A昀昀irm commences operations in the EU that generate net turnover that exceeds CSRD reporting thresholds, or if A昀昀irm-a昀昀iliated entity securities are listed in the EU, A昀昀irm may become subject to CSRD and CSDDD. The jurisdictional applicability of these frameworks will be monitored in future years. 2024 ESG REPORT 41