Building a New Kind of Payment Network

2022 Building a new kind of payment network that empowers consumers and helps merchants drive growth

How Affirm helps consumers Some financial products have historically benefited at consumers’ expense: prolonging and maximizing time in debt and charging fees without also adding value. Affirm took a long, hard look at the old system and knew that there had to be a better way, so we built it. Affirm empowers consumers by offering a transparent and flexible way to pay over time with no late or hidden fees. We provide consumers with increased purchasing power, and greater control over managing their finances. We enable consumers to pay at their own pace in biweekly or monthly payments, rather than entirely up front. Unlike many credit cards and other Buy Now, Pay Later options, Affirm doesn’t charge any hidden fees, not even late fees. The interest-bearing transactions we facilitate only include simple interest. This means that the interest is based upon a fixed percentage the consumer agrees to up front at checkout and it never compounds. Consumers who choose Affirm never owe a penny more than what they agree to at checkout, even if they’re late or miss a payment. How Affirm helps merchants Affirm helps merchants of all sizes drive growth and better serve their customers. We’ve proven that we can increase sales and introduce new consumers to our merchant partners. That’s why our partners include household-name brands across home and lifestyle, fashion, beauty, travel, fitness, auto service and parts, and more. This network is further bolstered by the Affirm app, which gives consumers a convenient way to use Affirm as an omnichannel payment method, while providing a marketplace for merchants to reach consumers. 2

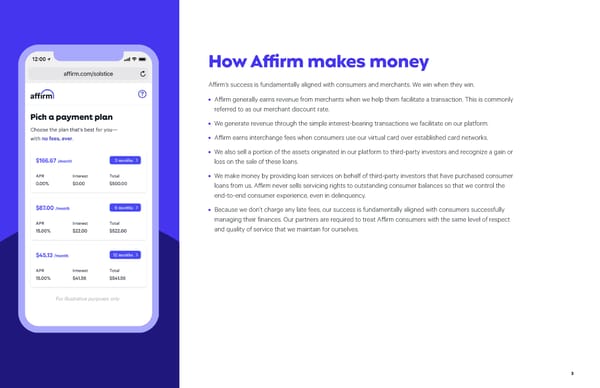

How Affirm makes money Affirm’s success is fundamentally aligned with consumers and merchants. We win when they win. • Affirm generally earns revenue from merchants when we help them facilitate a transaction. This is commonly referred to as our merchant discount rate. • We generate revenue through the simple interest-bearing transactions we facilitate on our platform. • Affirm earns interchange fees when consumers use our virtual card over established card networks. • We also sell a portion of the assets originated in our platform to third-party investors and recognize a gain or loss on the sale of these loans. • We make money by providing loan services on behalf of third-party investors that have purchased consumer loans from us. Affirm never sells servicing rights to outstanding consumer balances so that we control the end-to-end consumer experience, even in delinquency. • Because we don’t charge any late fees, our success is fundamentally aligned with consumers successfully managing their finances. Our partners are required to treat Affirm consumers with the same level of respect and quality of service that we maintain for ourselves. For illustrative purposes only 3

Affirm by the numbers as of June 30, 2022 2,500+ 14M ~235K employees active consumers active merchants $368 ~$15.5B 39% average order gross merchandise volume of loans are value (last twelve months) 0% APR $0 in late fees, penalties, deferred interest, or compound interest—ever 4

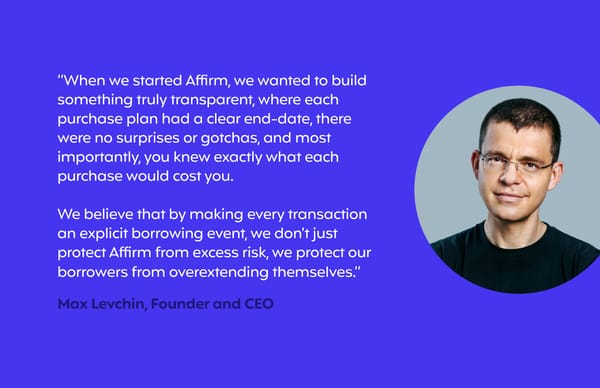

“When we started Affirm, we wanted to build something truly transparent, where each purchase plan had a clear end-date, there were no surprises or gotchas, and most importantly, you knew exactly what each purchase would cost you. We believe that by making every transaction an explicit borrowing event, we don’t just protect Affirm from excess risk, we protect our borrowers from overextending themselves.” Max Levchin, Founder and CEO

How it works: Our underwriting models assess a consumer’s ability to repay before making a real-time credit decision. Our models consider data beyond just traditional credit scores, including transaction history and credit usage. This approach enables responsibly Affirm to responsibly expand access to credit to a wide segment of consumers, including those whose traditional credit scores may not fully represent their creditworthiness as a borrower. expanding The nature of credit cards makes it all too easy for consumers to fall (or get left) behind. So we flipped the model on its head. We underwrite each transaction individually and—by never charging late fees—we do not profit when access to credit consumers fall behind. Our success is fundamentally aligned with our consumers’ success. • We enable eligible consumers at virtually any merchant to pay over time with term lengths ranging from 6 weeks to 60 months. • Affirm’s Pay in 4, buy now, pay later solution is always interest-free. • Affirm’s monthly payment option can be interest-free or can be interest-bearing with simple interest generally ranging from 10 to 36% APR, consistent with the 36% rate that has been supported by consumer advocacy groups and bipartisan members of Congress. • Affirm’s 0% APR offers have no deferred, hidden, or surprise interest or fees, ever. • Every transaction is underwritten individually. Payment options, including length of term and interest rate, may vary by merchant (subject to eligibility), the purchase amount, and the pay over time program the consumer chooses. • Facilitating simple interest-bearing transactions enables us to address more of our consumers’ and merchants’ needs responsibly. Simple interest means the interest is based on a fixed percentage that never compounds, so consumers never owe a penny more than what they agree to at checkout. • All Affirm consumers to whom credit is extended receive Truth in Lending disclosures for all our products, even when it is not required. This ensures that consumers receive consistent and transparent disclosures. 6

Regulatory Affirm was purpose-built from the ground up with core values of honesty, transparency, and putting people first. By aligning our interests with those of consumers, Affirm has strived for our policies to represent best practices in consumer protection oversight and regulatory compliance since inception. Our approach of putting what is best for consumers first is embedded across our products and is an essential part of our company’s culture. Our founder and CEO, Max Levchin, was a member of the and approach Consumer Financial Protection Bureau’s consumer advisory board from 2015 to 2018. We have actively engaged with regulators and policymakers as part of our mission to improve lives and meet the needs of consumers and merchants, while ensuring compliance with applicable laws and regulations. Affirm is subject to regulatory supervision and oversight, both directly and indirectly, by way of our partnership with our originating bank partners and under federal and state laws and the laws of the states in which we operate. This also includes licensing in states that require licensing of our interest-free Pay in 4 product with no late fees, as well as servicing and collection licenses required of us and our vendors. For more information on our licenses, see: Licenses, Notices, and Related Disclosures. The laws to which we are or may be subject to include but are not limited to: • Truth-in-Lending Act and Regulation Z • California Consumer Privacy Act and other data • Section 5 of the Federal Trade Commission Act protection laws and regulations, such as the EU • Section 1031 of the Dodd-Frank Act General Data Protection Regulation • Equal Credit Opportunity Act and Regulation B • Holder Rule and equivalent state laws • Fair Credit Reporting Act, as amended by the Fair and • Electronic Fund Transfer Act and Regulation E Accurate Credit Transactions Act, and Regulation V • Electronic Signatures in Global and National Commerce Act • Fair Debt Collection Practices Act and Regulation F • Military Lending Act • The Telephone Consumer Protection Act • Servicemembers Civil Relief Act • Gramm-Leach-Bliley Act and Regulation P • The Coronavirus Aid, Relief, and Economic Security Act Many states and local jurisdictions have laws analogous to, or in addition to, the laws listed above. We support efforts, including regulation, that promote transparency for consumers while providing the choice to utilize flexible and transparent solutions to pay over time. We are committed to engaging with all stakeholders as we continue to increase access to responsible financial products and meet consumer and merchant needs in the future. 7

8

Sustainably advancing our mission to improve lives At Affirm, our mission is to deliver honest financial products. Our purpose is not solely to improve the lives of consumers, merchants, shareholders, and our people, but also the communities in which we operate. We are creating a comprehensive sustainability program, called CodeGreen, where we plan to measure our carbon footprint and set ambitious goals to address our environmental impact. As part of CodeGreen, we collect carbon emissions data to help us create a baseline of our impact to showcase a quantifiable view and provide insights on where we can focus our ongoing efforts. We partner with different teams across Affirm that play a role in our footprint, to monitor their contributions, and create an action plan on how we can do better. Lastly, we host ongoing events and volunteering opportunities, such as community cleanups and lunch & learn webinars to keep our employees engaged. Affirm strives to apply the same transparency and value we provide to consumers to our environmental, social, and governance (ESG) efforts. Since Affirm’s founding, our mission has guided our work to build a great, growing, sustainable business that stands the test of time. We are united by our commitment to improve the lives of consumers, to help our partners grow their businesses, and to deliver lasting value to the communities in which we operate, starting with our special team of Affirmers. To achieve our objectives, we embrace a set of values that guide how we work. 9

Financial inclusion Affirm believes that access to responsible and affordable credit products is a key contributor to the financial health of consumers, and drives broad-based financial inclusion. Affirm offers products that promote access and opportunity for millions of Americans, especially low and moderate income (“LMI”) borrowers that would otherwise be left vulnerable to predatory lenders and high-interest-rate products. In fact, more than one-third of our overall 1 volume for the 12 months ending December 31, 2021 has gone to LMI customers. By looking at consumers as more than just their credit score, our underwriting is able to responsibly expand access to credit to more people, including those whose traditional credit scores may not represent their worthiness as a borrower. This provides critical access to honest and transparent financing to consumers who Importantly, Affirm underwrites each and every need it the most, without ever paying for hidden or late fees. transaction individually in order to assess a consumer’s ability to repay. We do not extend access to credit to consumers that we don’t believe can be repaid because we do not profit from their mistakes. 1. 36% of total loan volume originated between 1/2021 and 12/2021 has gone to borrowers with a stated income lower than 80% of the median household income according to HUD FY2020 limits. Median household income is determined at the zip code level in metropolitan areas defined by HUD and at the state level for zip codes falling outside of these metro areas. 10

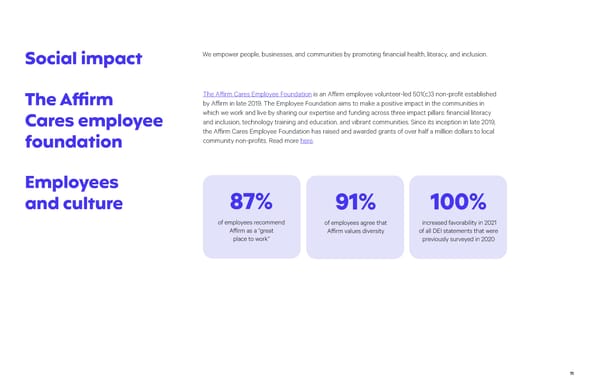

Social impact We empower people, businesses, and communities by promoting financial health, literacy, and inclusion. The Affirm The Affirm Cares Employee Foundation is an Affirm employee volunteer-led 501(c)3 non-profit established by Affirm in late 2019. The Employee Foundation aims to make a positive impact in the communities in which we work and live by sharing our expertise and funding across three impact pillars: financial literacy Cares employee and inclusion, technology training and education, and vibrant communities. Since its inception in late 2019, the Affirm Cares Employee Foundation has raised and awarded grants of over half a million dollars to local foundation community non-profits. Read more here. Employees 87% and culture 91% 100% of employees recommend of employees agree that increased favorability in 2021 Affirm as a “great Affirm values diversity of all DEI statements that were place to work” previously surveyed in 2020 11

Diversity, equity, At Affirm, we believe that diversity, equity, and inclusion are vital. We embed DEI into all processes, programs, and structures at Affirm—from how we conduct business to how we hire, develop, advance, and retain talent. and inclusion • 75%+ of Affirm’s board of directors are from underrepresented groups 3 female directors (DEI) at Affirm 4 directors identify as Asian or Black 1 director identifies as LGBTQIA+ • 40%+ of Affirm’s executive leadership team are women • Over 2,100 of Affirm’s merchant partners are certified as Women-, Veteran-, or Minority-Owned businesses, as of the quarter ending March 31, 2022 • Take an in-depth look at our workforce demographics, goals, accomplishments, and future plans in our 2021 DEI report Dedicated DEI team Resources & education plus ERGs, CGs, and DISC Training on unconscious bias, diversity hiring strategy, Diversity and Inclusion Steering Committee (DISC): inclusive leadership, and more. A group of senior-level leaders from across Affirm work to advance DEI throughout the company. A yearly DEI report to promote transparency and report progress towards goals and a quarterly newsletter to Employee Resource Groups (ERGs) and Community keep Affirmers aware of DEI opportunities and updates. Groups (CGs) promote belonging and inclusion. Ongoing utilization of third-party tools to assess parity in compensation-related processes. 12

Diversity, equity, Hiring Merchant diversity and inclusion Underrepresented groups (URG) sourcing Affirm promotes URG merchants through (DEI) at Affirm sessions: Recruiters host regular sessions with quarterly multicultural campaigns, including hiring teams across all departments to source but not limited to Black History Month, candidates from underrepresented groups. Women’s Month, AAPI Heritage Month, and Latinx Heritage Month. Affirm partners with a number of external Shop Black-Owned Businesses page – professional groups to ensure we maintain an evergreen page on Affirm.com that provides a diverse candidate pool, including: a directory of Black-Owned Businesses. • Nextplay, a global community of 20,000+ Ongoing Client Diversity Survey – collects experienced Black & Latinx tech, engineering, data on Affirm merchants owned by diverse and business professionals. In 2021, we communities; enforces Affirm’s commitment sponsored and attended their Black History to DEI within our merchant network. Month and Latinx History Month events. • BreakLine, to help grow our pipeline of candidates from underrepresented groups across multiple verticals. 13

Companywide Gender By Country and Total (Excludes Poland & Australia) United States Canada Spain Male (55.1%) Male (49.4%) Male (85.1%) Female (43.6%) Female (50.6%) Female (14.9%) Non-Binary (1.3%) People Managers VP+ Male (55.2%) Non-Binary (1.0%) Male (56.7%) Non-Binary (0.8%) Male (60.8%) Female (43.6%) Unknown (0.2%) Female (42.3%) Unknown (0.2%) Female (39.2%) Our data for race/ethnicity is limited to the U.S only due to differing standards and laws in the various countries where Affirm has employees. We’re reporting data for countries with 5 employees or more. 14

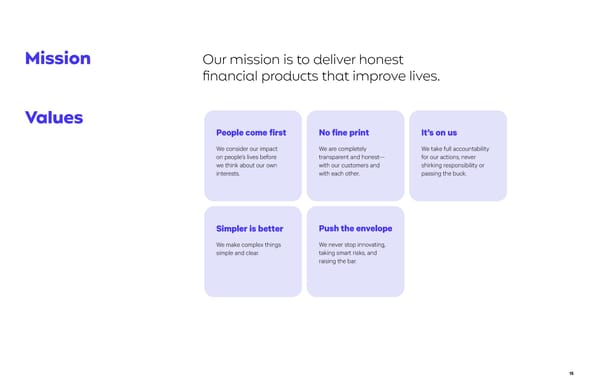

Mission Our mission is to deliver honest financial products that improve lives. Values People come first No fine print It’s on us We consider our impact We are completely We take full accountability on people’s lives before transparent and honest— for our actions, never we think about our own with our customers and shirking responsibility or interests. with each other. passing the buck. Simpler is better Push the envelope We make complex things We never stop innovating, simple and clear. taking smart risks, and raising the bar. 15

Awards Best Remote-First Companies 2020 CNBC Disruptor 50 Forbes Disruptive to Work for in 2021 and 2022 Innovator 2020 2016 Fast Company FinTech for Good: Affirm Cares 50 Most Innovative Employee Foundation 16

Investing in our people Remote-first Supportive Health workforce communities benefits Affirmers can set up Employee resource groups US Specific: Health, dental, shop anywhere in their and community groups vision, basic life & AD&D, home country with and short- and long-term remote-first roles Affirm Cares employee disability 100% covered foundation that aims to by Affirm make a positive impact in the communities in which Free access to mental we work and live health support and clinical family planning support Global: Comprehensive Spending wallets Generous time off health insurance and wellness plans Tech, food, and lifestyle ~20 company-wide paid wallets for expenses “Away Days” in addition Free access to mental to vacation days health support and clinical $20,000* S.A.F.E. journey family planning support wallet (family planning) 18 weeks paid leave for birth and non-birth parents *Or market equivalent depending on country 4-week return to work transition program for returning parents 17

Protecting data is our top priority We apply best practices that align with security industry standards for protecting personal information. Our policies safeguard the collection, use, and disclosure of information. We use a variety of methods to keep our network secure and data safe. More information can be found here. Data security When consumers share personal information, it’s transferred with TLS 1.2 or higher, a cryptographic protocol, then stored with AES 256-bit or higher encryption at rest. Restricted access We store encryption keys at an off-site facility. Access to customer data requires multi-factor authentication and is restricted to authorized personnel. How Affirm utilizes information Providing consumers control over privacy choices To perform and improve our services, including: performing transactions, maintaining accounts, Consumers are able to opt out at any time by and delivering relevant marketing based on changing their preferences in the app or emailing consumers’ communication preferences. help@affirm.com. Consumers have the right to receive notice of any Affirm never sells personal information. information we collect and to request or delete personal information, subject to applicable laws. 18

Environmental impact We actively manage our environmental impact across all areas of our operations. This includes practices and partnerships focused on addressing climate change, sustainably managing resources, and mitigating our environmental impact. We have partnered with an emission data collection platform to help us create a baseline on our carbon footprint. Energy and resource data collection will showcase a quantifiable view of Affirm’s impact and provide insights on where we can focus our ongoing efforts and make improvements. Notable certifications • Gold-certified LEED headquarters • Certified Green Business of the City and County of San Francisco • Requirements include: employee education, reducing waste footprint and increasing diversion rate, toxics reduction, green purchasing, and resource conservation Sustainable food practices • Saved over 19,000 pounds of produce that would have gone to waste and over 109,000 gallons of water, reducing our carbon footprint by +65,000 pounds of CO2e • Partnered with Good Use juice to reduce waste by using only “ugly” and surplus fresh produce that otherwise would have been disposed of in a landfill 19

Waste management We prioritize company-wide engagement, including information sessions, volunteer events, panels, and regular updates to educate employees on the importance of sustainability in their daily lives. Prior to becoming a remote-first company, the vast majority of our sustainability efforts were focused on waste management and water conservation. Those efforts contributed to saving: • +540 pounds of waste from going into landfills each year • +500,000 disposable dishes from going into landfills • +116,000 pounds of carbon dioxide from going into the atmosphere • +80,000 gallons of water each month In addition, we have also taken the following actions to further our sustainability efforts: • Increased our waste diversion rate from 80% to 90% • Partnered with TerraCycle to reduce waste ending up in landfills and to ensure proper recycling of food and beverage and PPE products in our offices • Partnered with DishCraft to implement durable serviceware, replace compostables, and use gray water to clean dishes before they were run through a sanitation solution 20

Cautionary This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve risks and uncertainties. note about All statements other than statements of historical fact are forward-looking statements, including statements regarding: our strategy and future operations, including partnerships with certain key merchants and commerce platforms; the forward-looking development, innovation, introduction and performance of, and demand for, our products, including the Debit+ Card; acquisition and retention of merchants and consumers; our future growth, investments, network expansion, product mix, brand awareness, financial position, gross market value, revenue, transaction costs, operating income, provision for credit statements losses, and cash flows; and general economic trends and trends in our industry and markets. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Risks, uncertainties and assumptions include factors relating to: our need to attract additional merchants, partners and consumers and retain and grow our relationships with existing merchants, partners and consumers; the highly competitive nature of our industry; our need to maintain a consistently high level of consumer satisfaction and trust in our brand; the concentration of a large percentage of our revenue and GMV with a small number of merchant partners and commerce platforms; our ability to sustain our revenue growth rate or the growth rate of our related key operating metrics; the terms of our agreement with one of our originating bank partners; our existing funding arrangements that may not be renewed or replaced or our existing funding sources that may be unwilling or unable to provide funding to us on terms acceptable to us, or at all; our ability to effectively underwrite loans facilitated through our platform and accurately price credit risk; the performance of loans facilitated through our platform; changes in market interest rates; our securitizations, warehouse credit facilities and forward flow agreements; the impact on our business of general economic conditions, the financial performance of our merchants, and fluctuations in the U.S. consumer credit market; our ability to grow effectively through acquisitions or other strategic investments or alliances; seasonal fluctuations in our revenue as a result of consumer spending patterns; pending and future litigation, regulatory actions and/or compliance issues;and other risks that are described in our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q and in our other filings with the Securities and Exchange Commission. These forward-looking statements reflect our views with respect to future events as of the date hereof and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. The forward-looking statements are made as of the date hereof, and we assume no obligation and do not intend to update these forward-looking statements. Payment options through Affirm are subject to eligibility and are provided by these lending partners: affirm.com/lenders. 21